Questions about retirement planning and tax efficiency have appeared frequently in IELTS Writing Task 2, particularly in the last 5 years. Based on analysis of past exam patterns, this topic has a high probability of appearing in future tests, especially in countries with aging populations like Japan, South Korea, and China.

Analysis of Topic and Question Types

The most common question type related to tax-efficient retirement planning appeared in the March 2023 IELTS exam:

Some people believe that individuals should be responsible for planning their own retirement and managing their money for old age. Others say governments should provide retirement planning advice and ensure citizens save enough for retirement through mandatory pension programs. Discuss both views and give your opinion.

Detailed Question Analysis

This question requires:

- Discussion of two contrasting views on retirement planning responsibility

- Analysis of individual vs. government role

- Clear position with supporting arguments

- Relevant examples and explanations

Sample Essay 1 (Band 8.5)

The debate over retirement planning responsibility has become increasingly important as populations age worldwide. While some advocate for complete individual autonomy in retirement preparation, others support government intervention. I believe a balanced approach combining both individual initiative and government oversight is most effective.

Those supporting individual responsibility argue that personal financial planning allows for maximum flexibility and customization. People can adjust their savings and investment strategies based on their unique circumstances, risk tolerance, and retirement goals. Furthermore, self-directed retirement planning encourages financial literacy and responsible money management habits. For example, in Singapore, individuals who actively manage their Central Provident Fund accounts often achieve better returns through strategic investment choices.

However, proponents of government involvement highlight several compelling benefits. Mandatory pension programs ensure universal coverage and protect vulnerable populations who might otherwise face poverty in old age. Government oversight can also prevent fraudulent schemes and provide reliable financial education. Japan’s national pension system demonstrates how government guidance helps maintain social stability by guaranteeing basic retirement income for all citizens.

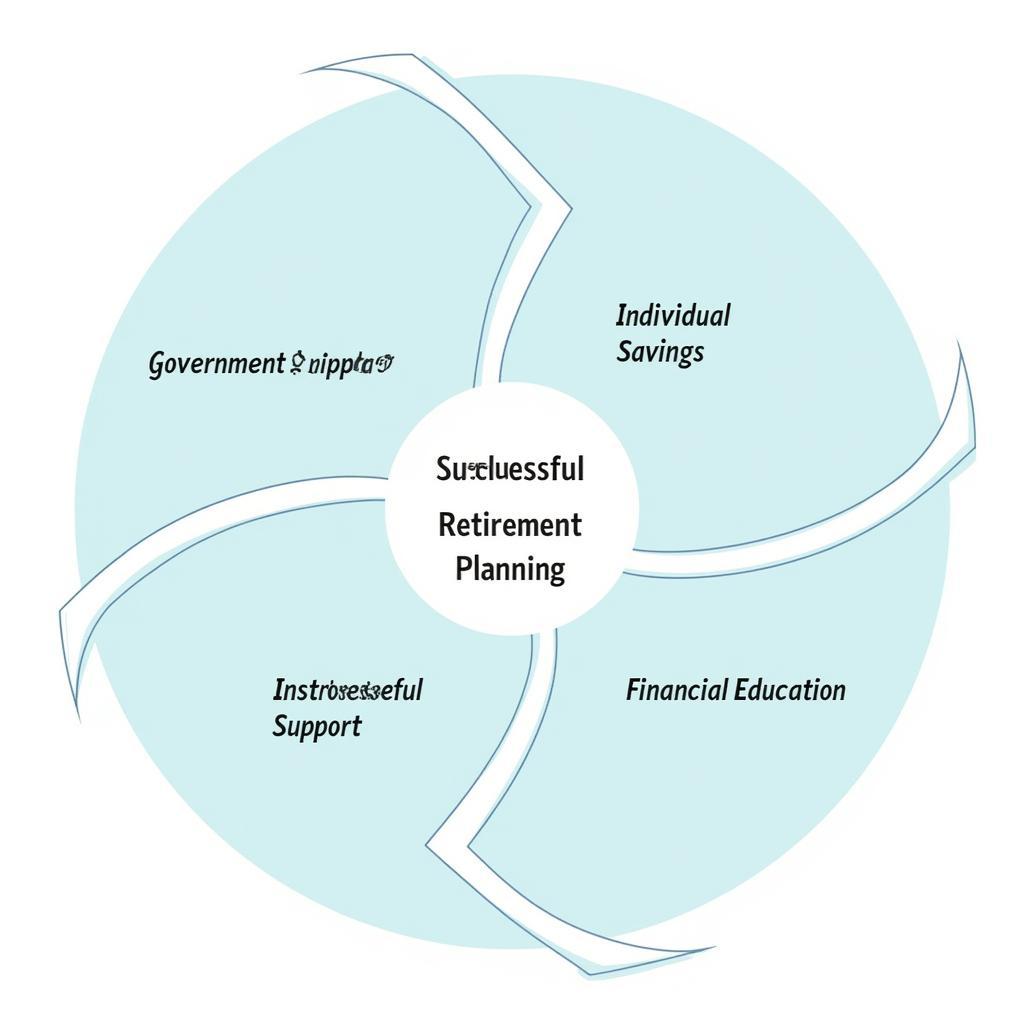

In my view, the most effective approach combines both perspectives. Governments should establish mandatory minimum contribution requirements and provide basic financial education, while individuals retain flexibility to supplement these programs with personal savings and investments. This hybrid model, similar to Australia’s superannuation system, balances social protection with personal choice. Additionally, tax incentives for retirement savings can motivate individuals while ensuring adequate preparation for retirement.

Evidence from various countries supports this balanced approach. For instance, countries with robust public-private pension partnerships, such as Denmark and the Netherlands, consistently rank highest in retirement security indices.

Sample Essay 2 (Band 6.5)

Nowadays, many people worry about their retirement savings. Some think individuals should manage their own retirement money, but others want governments to help. I will discuss both sides and give my opinion.

For individual responsibility, people can choose how to save their money. They know their needs better than the government and can make personal decisions. Some people want to invest in stocks, while others prefer safer options like bank deposits. Also, when people manage their own money, they learn about finance.

However, government involvement has benefits too. Many people don’t know much about financial planning, so government advice helps them. Mandatory pension programs make sure everyone saves something for retirement. This prevents poverty among old people. The government can also protect people from bad investment schemes.

I think both approaches are important. Governments should provide basic pension systems and financial education. But people should also have freedom to make extra savings and investments. This way, everyone has basic protection but can also plan for their personal goals.

For example, in my country, we have government pensions, but many people also save extra money in private retirement accounts. This system works well because it combines safety with flexibility.

Scoring Analysis

Band 8.5 Essay Features:

- Sophisticated vocabulary: “vulnerable populations,” “fraudulent schemes,” “hybrid model”

- Complex sentence structures with proper linking

- Clear progression of ideas

- Strong examples and evidence

- Balanced argument with nuanced opinion

Band 6.5 Essay Features:

- Basic but clear vocabulary

- Simple but mostly accurate grammar

- Limited range of complex structures

- Basic examples

- Logical but simple organization

Key Vocabulary

- pension scheme (n) /ˈpenʃən skiːm/ – retirement savings program

- mandatory (adj) /ˈmændətɔːri/ – required by law

- retirement security (n) /rɪˈtaɪəmənt sɪˈkjʊərəti/ – financial stability during retirement

- financial literacy (n) /faɪˈnænʃəl ˈlɪtərəsi/ – understanding of money management

- superannuation (n) /ˌsuːpərənjuˈeɪʃən/ – retirement benefit system

Consider practicing with these related topics:

- Role of private pension funds vs. state pensions

- Impact of aging population on retirement systems

- Financial education in schools and retirement planning

Share your practice essays in the comments for feedback and discussion!