Credit card usage and debt is a topic that has appeared frequently in IELTS Writing Task 2 exams over the past few years. Based on an analysis of recent test reports and trends, it is highly likely that this theme will continue to be a popular subject in future IELTS exams. To help you prepare effectively, we have selected a relevant question that closely resembles those seen in actual tests:

In recent years, credit card debt has increased dramatically in many countries. What are the reasons for this? What problems does this cause for individuals and society?

Analyzing the Question

This question is a typical problem-and-solution type in IELTS Writing Task 2. It consists of two parts:

- Reasons for the increase in credit card debt

- Problems caused by this increase for individuals and society

To answer this question effectively, you need to:

- Identify at least 2-3 reasons for the increase in credit card debt

- Discuss problems for both individuals and society

- Provide specific examples to support your points

- Use appropriate vocabulary related to finance and economics

Sample Essays

Band 8-9 Essay

The proliferation of credit card debt has become a significant concern in numerous nations in recent years. This essay will explore the primary factors contributing to this trend and examine its detrimental effects on both individuals and society as a whole.

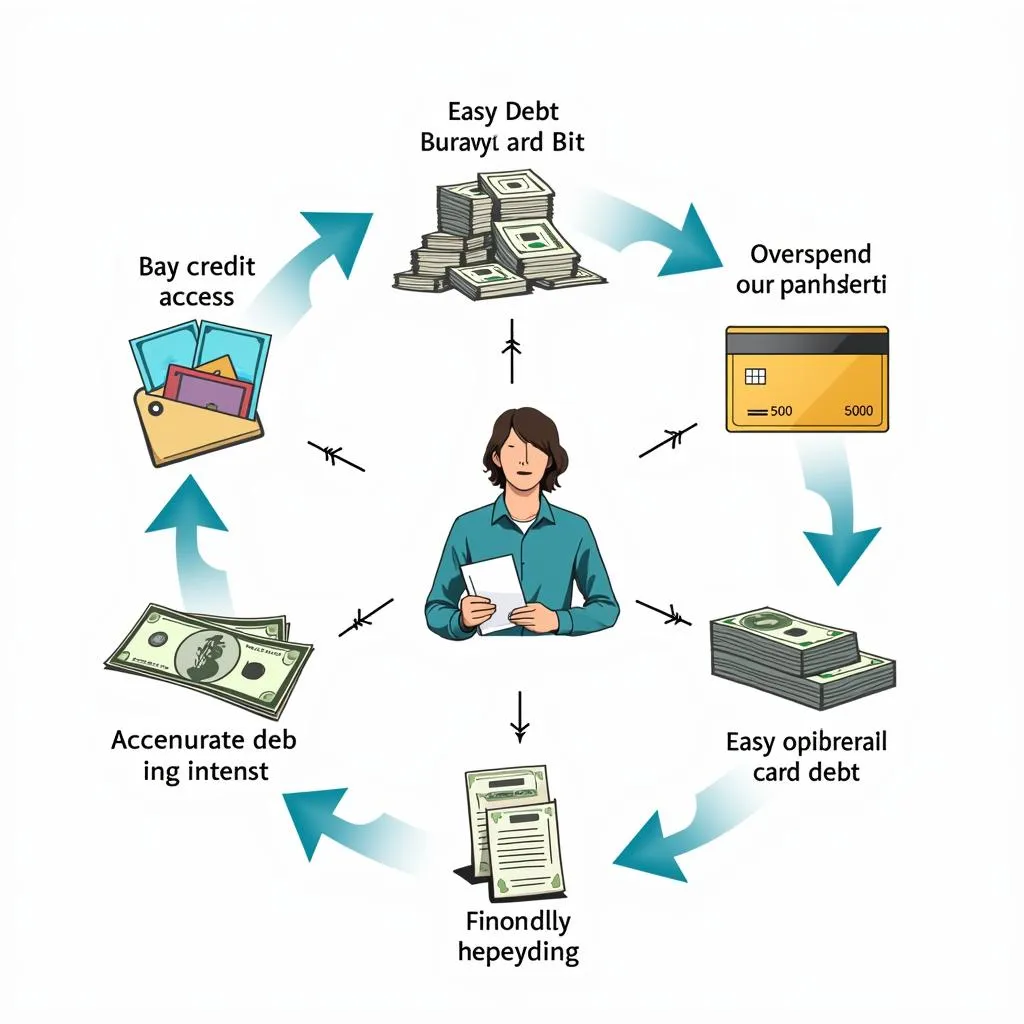

Several reasons account for the surge in credit card debt. Firstly, the ease of obtaining credit cards and the aggressive marketing tactics employed by financial institutions have led to widespread adoption. Many people are lured by attractive introductory offers and fail to fully comprehend the long-term financial implications. Secondly, consumerism and the desire for instant gratification have fueled impulsive spending habits, encouraging individuals to live beyond their means. Lastly, financial illiteracy and a lack of budgeting skills have resulted in poor money management, causing many to rely heavily on credit cards for everyday expenses.

The ramifications of escalating credit card debt are far-reaching for both individuals and society. On a personal level, high-interest rates can trap individuals in a cycle of debt, leading to financial stress, decreased quality of life, and even mental health issues. Moreover, excessive debt can damage credit scores, limiting future opportunities for loans, housing, and employment. From a societal perspective, widespread credit card debt can have a destabilizing effect on the economy. It can lead to reduced consumer spending in the long run, as individuals struggle to repay their debts, potentially slowing economic growth. Additionally, the financial strain on individuals may increase reliance on government welfare programs, placing a burden on public resources.

In conclusion, the dramatic increase in credit card debt stems from a combination of easy access to credit, consumerist culture, and financial illiteracy. The consequences of this trend are severe, affecting both personal well-being and economic stability. To address this issue, it is crucial to promote financial education and encourage responsible spending habits.

This essay demonstrates characteristics of a Band 8-9 response:

- Coherent structure with clear introduction, body paragraphs, and conclusion

- Fully addresses all parts of the question with well-developed ideas

- Uses a wide range of vocabulary accurately (e.g., “proliferation,” “detrimental,” “ramifications”)

- Employs various complex sentence structures

- Presents ideas logically with appropriate paragraphing

- Uses cohesive devices effectively (e.g., “Firstly,” “Moreover,” “Additionally”)

Band 6-7 Essay

In recent years, many countries have seen a big increase in credit card debt. This essay will discuss the reasons for this problem and its effects on people and society.

There are several reasons why credit card debt has gone up. First, it’s very easy to get a credit card these days. Banks and companies offer them to almost everyone, even students. Second, many people use credit cards to buy things they can’t really afford. They want new phones, clothes, or holidays, and credit cards let them buy now and pay later. Also, some people don’t understand how credit cards work properly. They don’t realize how much interest they have to pay if they don’t pay the full amount each month.

This increase in credit card debt causes problems for individuals and society. For individuals, high debt can lead to a lot of stress. People worry about how to pay their bills and might have trouble sleeping or feel depressed. It can also damage their credit score, making it hard to get loans or mortgages in the future. For society, if many people have a lot of debt, it can affect the economy. People with debt might spend less money, which can slow down economic growth. The government might also have to spend more money to help people with debt problems.

In conclusion, credit card debt has increased because of easy access to credit cards, people’s desire to buy things they can’t afford, and a lack of understanding about how credit cards work. This causes stress for individuals and can harm the economy. It’s important for people to learn more about managing money and using credit cards responsibly.

This essay demonstrates characteristics of a Band 6-7 response:

- Addresses all parts of the question with relevant ideas

- Has a clear overall structure but less sophisticated paragraphing

- Uses some less common vocabulary (e.g., “mortgages,” “economic growth”) mixed with simpler terms

- Employs a mix of simple and complex sentence structures

- Uses some cohesive devices but less skillfully than the Band 8-9 essay

- Ideas are presented logically but with less depth and precision

Band 5-6 Essay

Nowadays, credit card debt is a big problem in many countries. In this essay, I will talk about why this happens and what problems it makes.

There are some reasons why people have more credit card debt. First, it’s easy to get a credit card. Many people can get one, even if they don’t have a good job. Second, people like to buy many things. They see advertisements for new phones or clothes and want to buy them. Credit cards let them buy things even if they don’t have money now. Also, some people don’t know how to use credit cards well. They don’t know they have to pay extra money if they don’t pay all the money back quickly.

This credit card debt makes problems for people and society. For people, it can make them very worried. They might not sleep well because they think about their debt. It can also make it hard for them to get money from banks later. For society, if many people have debt, it’s bad for the country’s money. People with debt don’t buy many things, so shops might not sell much. The government might need to help people with debt, which costs a lot of money.

In conclusion, credit card debt is increasing because it’s easy to get cards, people want to buy many things, and they don’t understand credit cards well. This makes problems for people and the whole country. People should learn more about using money and credit cards carefully.

This essay demonstrates characteristics of a Band 5-6 response:

- Addresses the main parts of the question but with limited development

- Has a basic structure but lacks sophisticated paragraphing

- Uses mostly simple vocabulary with some attempts at more advanced terms

- Predominantly uses simple sentence structures with some errors

- Uses basic cohesive devices (e.g., “First,” “Second,” “Also”)

- Ideas are relevant but lack depth and precision

Key Vocabulary to Remember

- Proliferation (noun) – /prəˌlɪf.əˈreɪ.ʃən/ – rapid increase or spread

- Consumerism (noun) – /kənˈsjuː.mə.rɪ.zəm/ – the protection or promotion of consumers’ interests

- Instant gratification (noun phrase) – /ˌɪn.stənt ˌɡræt.ɪˈfɪ.keɪ.ʃən/ – the desire to experience pleasure or fulfillment without delay

- Financial illiteracy (noun phrase) – /faɪˈnæn.ʃəl ɪˈlɪt.ər.ə.si/ – lack of understanding about financial matters

- Ramifications (noun) – /ˌræm.ɪ.fɪˈkeɪ.ʃənz/ – consequences or implications of an action or decision

- Destabilizing (adjective) – /diːˈsteɪ.bə.laɪ.zɪŋ/ – causing instability or insecurity

- Economic stability (noun phrase) – /ˌiː.kəˈnɒm.ɪk stəˈbɪl.ə.ti/ – the state of an economy with minimal fluctuations in output and employment

- Aggressive marketing (noun phrase) – /əˈɡres.ɪv ˈmɑː.kɪ.tɪŋ/ – forceful and competitive promotion of products or services

- Credit score (noun) – /ˈkred.ɪt skɔːr/ – a number representing a person’s creditworthiness

- Financial strain (noun phrase) – /faɪˈnæn.ʃəl streɪn/ – difficulty or stress related to money matters

In conclusion, credit card usage and debt remain crucial topics in IELTS Writing Task 2. To excel in your exam, practice writing essays on this theme, focusing on developing well-structured arguments, using appropriate vocabulary, and providing relevant examples. Remember to analyze the question carefully and address all parts in your response. As an exercise, try writing your own essay on the given topic and share it in the comments section for feedback and discussion. This active practice will significantly improve your IELTS writing skills.