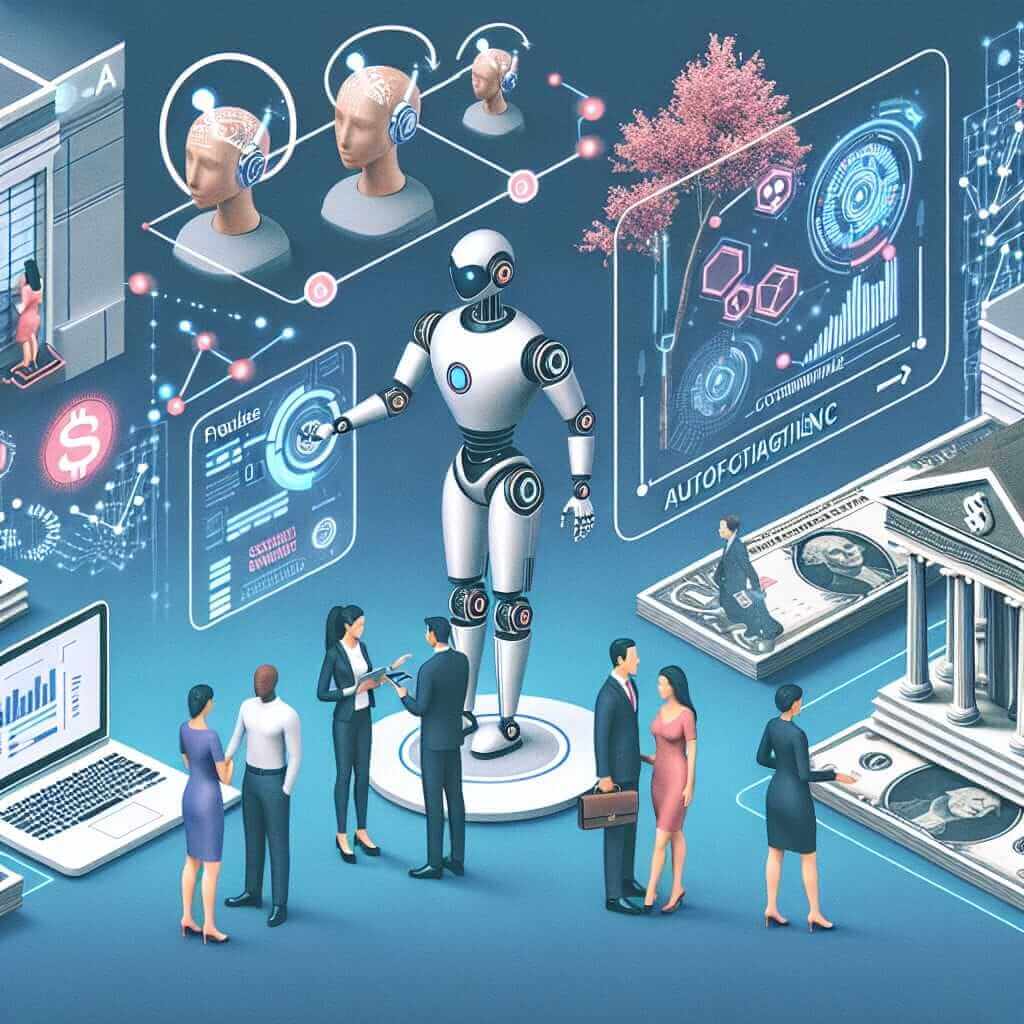

The IELTS Reading section often presents topics relevant to contemporary issues and modern technological advancements. One such pertinent topic is the impact of automation on the future of financial services. This subject isn’t just globally significant but also content-rich, making it a prime candidate for IELTS Reading tests.

Automation in financial services includes processes such as robo-advisors, machine learning algorithms for credit scoring, and blockchain technologies for transactions. Historically, automation’s influence on various sectors has been a common theme in reading passages, suggesting a high likelihood of similar content in future tests.

Automation in Financial Services

Automation in Financial Services

Sample IELTS Reading Passage

The Influence of Automation on Financial Services

Paragraph 1:

Over recent decades, technology has permeated every aspect of financial services, transforming how services are delivered and consumed. Automation, a byproduct of technological advancement, has significantly influenced the financial sector. From processing transactions to customer service, automation technologies have made financial services faster, more efficient, and more accessible.

Paragraph 2:

One of the most transformative aspects of automation in financial services is the advent of robo-advisors. These automated platforms provide financial advice based on algorithms and data analytics, allowing investors from all walks of life to access professional investment strategies without the high costs associated with traditional financial advisors. Robo-advisors evaluate an individual’s financial situation and risk tolerance to recommend appropriate investment portfolios.

Paragraph 3:

Machine learning and artificial intelligence are also revolutionizing credit scoring models. Traditional credit scoring relies on static models, whereas automated systems continuously learn from a vast amount of data, providing more accurate and dynamic credit scores. These advanced models can predict a borrower’s creditworthiness with greater accuracy, reducing the risk for lenders and increasing access to credit for consumers.

Paragraph 4:

Furthermore, blockchain technology is reshaping financial transactions. Blockchain’s decentralized nature ensures transparency and security, reducing the need for intermediaries. Financial institutions leverage blockchain for various applications, including cross-border transactions, fraud detection, and contract verification. This technology promises to minimize transaction costs and enhance the speed of financial operations.

Paragraph 5:

However, the widespread adoption of automation in financial services also raises several concerns. The potential job displacement is one significant issue, as automated systems replace manual processes. Additionally, cybersecurity risks and data privacy concerns become more pronounced as financial systems become increasingly digitized.

Sample Questions and Answers

Section 1: True/False/Not Given

-

Automated financial advisors charge higher fees than traditional advisors.

- False

-

Machine learning improves the accuracy of credit scoring models.

- True

-

Blockchain technology increases the need for financial intermediaries.

- False

Section 2: Matching Headings

Match each paragraph (1-5) with the appropriate heading (A-E):

- A. Concerns regarding automation in financial services

- B. Automation’s impact on financial service delivery

- C. The benefits of robo-advisors

- D. Blockchain’s role in financial transactions

- E. Machine learning’s influence on credit scoring

Answers:

- B

- C

- E

- D

- A

Section 3: Short-answer Questions

-

What technology provides financial advice based on algorithms?

- Robo-advisors

-

What kind of AI technology is improving credit scoring models?

- Machine learning

-

Which technology ensures transparency in financial transactions?

- Blockchain

Answer Keys and Explanations

-

Automated financial advisors charge higher fees than traditional advisors. – False

- Explanation: The passage states that robo-advisors allow investors to access professional strategies without high costs, implying they are cheaper.

-

Machine learning improves the accuracy of credit scoring models. – True

- Explanation: The text indicates that machine learning provides more accurate and dynamic credit scores.

-

Blockchain technology increases the need for financial intermediaries. – False

- Explanation: The passage explains that blockchain reduces the need for intermediaries.

-

Matching Headings:

- Paragraph 1 (B): Discusses automation’s overall impact on service delivery.

- Paragraph 2 (C): Focuses on the benefits and cost-efficiency of robo-advisors.

- Paragraph 3 (E): Describes how machine learning improves credit models.

- Paragraph 4 (D): Explains blockchain’s influence on financial operations.

- Paragraph 5 (A): Addresses concerns about job displacement and cybersecurity.

-

Short-answer Questions:

- Robo-advisors

- Machine learning

- Blockchain

Common Mistakes and Tips

- Misinterpreting True/False/Not Given Questions: Ensure you read carefully to determine whether the information is stated or implied in the passage.

- Matching Headings: Focus on the main idea of each paragraph, not just keywords.

- Time Management: Practice under timed conditions to improve speed without compromising accuracy.

Vocabulary

- Algorithm (n): /ˈælɡərɪðəm/ – A process or set of rules followed by a computer.

- Creditworthiness (n): /ˈkrɛdɪtˌwɜrðinɪs/ – The likelihood of a borrower repaying a loan.

- Intermediaries (n): /ˌɪntərˈmidiˌɛriz/ – Entities that act as a middleman in transactions.

- Decentralized (adj): /ˌdiˈsɛntrəˌlaɪzd/ – Distributed away from a central location or authority.

Grammar Structures

- Passive Voice: “Automation has significantly influenced the financial sector.”

- Relative Clauses: “One significant issue is the potential job displacement, as automated systems replace manual processes.”

- Comparative Structures: “Traditional credit scoring relies on static models, whereas automated systems continuously learn from a vast amount of data.”

Final Advice

To excel in the IELTS Reading section, immerse yourself in high-quality practice materials. Focus on understanding the passage structure, honing time management skills, and expanding your vocabulary. Equipped with these tools, you are well on your way to achieving a high score in the Reading section.