The Reading section of the IELTS exam is designed to assess candidates’ ability to understand and interpret written English. One prevalent topic in recent years is the application of blockchain technology in various fields, particularly in global remittances. This topic has increasingly appeared in reading passages due to its global relevance and cutting-edge significance. Understanding this topic can not only prepare you for the exam but also provide insights into a significant technological advancement.

In this article, we will provide a comprehensive reading exercise based on the topic “How is blockchain technology being used in global remittances?”, complete with a full passage, questions, answers, explanations, vocabulary, and grammar notes.

Reading Passage and Questions

Reading Passage

Blockchain Technology in Global Remittances

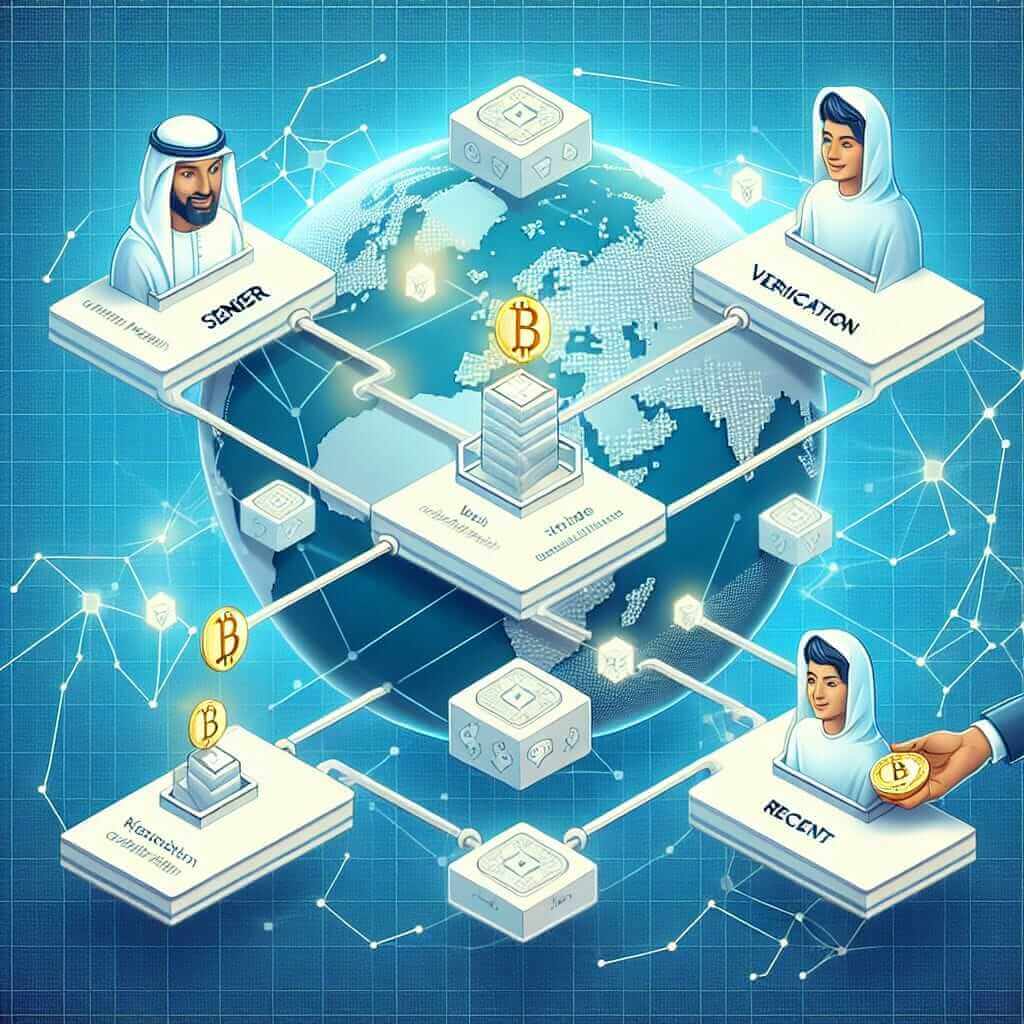

Blockchain technology, a decentralized ledger system, has revolutionized various industries by offering secure, transparent, and immutable transaction records. One of the most transformative impacts of blockchain is in the area of global remittances.

Traditionally, cross-border money transfers are expensive and time-consuming, often taking several days and involving high fees. Banks and transfer services play intermediaries, each charging fees and contributing to delays. However, blockchain technology is reducing these inefficiencies significantly.

Firstly, blockchain allows for near-instantaneous transfers. Instead of taking days, transactions can now be settled in a matter of minutes. This speed is particularly beneficial for migrant workers sending money back home, ensuring their families receive funds promptly.

Furthermore, the cost of remittances is greatly reduced. With blockchain, the need for intermediaries is eliminated. Digital currencies like Bitcoin or Ripple can be transferred almost instantly and at a fraction of the cost. This reduction in fees can be crucial for low-income individuals, who rely heavily on these funds.

Security is also a major advantage. Blockchain’s immutable nature ensures that once a transaction is recorded, it cannot be altered, reducing fraud risks. Transactions are verified through a consensus mechanism, ensuring their validity and transparency.

Moreover, blockchain can provide financial access to the unbanked. Many individuals in developing countries do not have access to traditional banking systems. Blockchain can offer them a means to receive and send money using only a smartphone, promoting financial inclusion.

In conclusion, blockchain technology stands to revolutionize global remittances by making transactions faster, cheaper, and more secure. As more people and institutions adopt this technology, we can expect significant changes in the way money is transferred worldwide.

Questions

Multiple Choice

-

What is one of the major benefits of blockchain technology for global remittances?

A. Traditional banking involvement

B. Lengthy transaction times

C. Instantaneous transfers

D. High transaction fees -

Which digital currencies are mentioned in the passage?

A. Bitcoin and Ripple

B. Ethereum and Litecoin

C. Dogecoin and Tether

D. Cardano and Polkadot

Identifying Information (True/False/Not Given)

-

Blockchain technology can take several days to complete a transaction.

True / False / Not Given -

The passage states that the blockchain technology is immutable.

True / False / Not Given

Matching Headings

- Match the following subheadings to the relevant paragraphs:

i. Financial inclusion using blockchain technology

ii. Cost reductions in remittances

iii. Security advantages of blockchain

iv. Traditional remittance inefficiencies

Answers and Explanations

- C. Instantaneous transfers – The passage states that transactions can be settled in minutes with blockchain technology.

- A. Bitcoin and Ripple – These two digital currencies are mentioned explicitly in the passage.

- False – The passage indicates that blockchain transactions are near-instantaneous, not taking several days.

- True – The passage mentions that blockchain’s immutable nature ensures that once a transaction is recorded, it cannot be altered.

- i. Financial inclusion using blockchain technology – Paragraph on financial access to the unbanked.

ii. Cost reductions in remittances – Paragraph on cost reduction benefits.

iii. Security advantages of blockchain – Paragraph on the security advantages.

iv. Traditional remittance inefficiencies – Paragraph discussing traditional cross-border money transfers.

Common Mistakes in This Type of Exercise

- Misinterpreting the passage context: Students often fail to grasp the overall message.

- Overlooking details: Important details leading to the correct answer can be easily missed.

- Matching errors: Confusing subheadings and misallocating them to the relevant paragraphs.

Vocabulary

- Immutable (adj) [ɪˈmjuː.tə.bəl]: unchanging over time or unable to be changed.

- Decentralized (adj) [diːˈsɛn.trə.laɪzd]: controlled by several local offices or authorities rather than one single place.

- Intermediaries (n) [ˌɪn.tərˈmiː.di.riz]: a person or organization that makes business or financial arrangements between parties.

- Consensus (n) [kənˈsɛn.səs]: a general agreement.

Grammar Points

-

Passive Voice: “Transactions can now be settled in a matter of minutes.”

- Structure: [subject] + [to be] + past participle

- Usage: Emphasis on the action rather than the subject.

-

Relative Clauses: “Many individuals in developing countries who do not have access to traditional banking systems.”

- Structure: [noun] + [relative pronoun] + [clause]

- Usage: Adding further information about the noun.

Tips for High IELTS Reading Scores

- Practice regularly: Consistent practice helps improve speed and accuracy.

- Skim and scan: Quickly identify the main ideas before diving into details.

- Understand question types: Familiarize yourself with different question formats to anticipate what information to look for.

- Expand your vocabulary: A broader vocabulary enables better comprehension of complex texts.

- Review and reflect: Analyzing mistakes and understanding why they happened ensures improvement over time.