Mortgage refinancing and its impact on household debt is a complex economic topic that has gained relevance in recent years. While not a frequent subject in IELTS Writing Task 2, it falls under the broader categories of economics and personal finance, which do appear regularly. Based on analysis of past IELTS exams, we can expect questions related to this theme to occasionally surface, particularly in countries where mortgage markets are significant.

Let’s examine a relevant IELTS Writing Task 2 question that aligns closely with this topic:

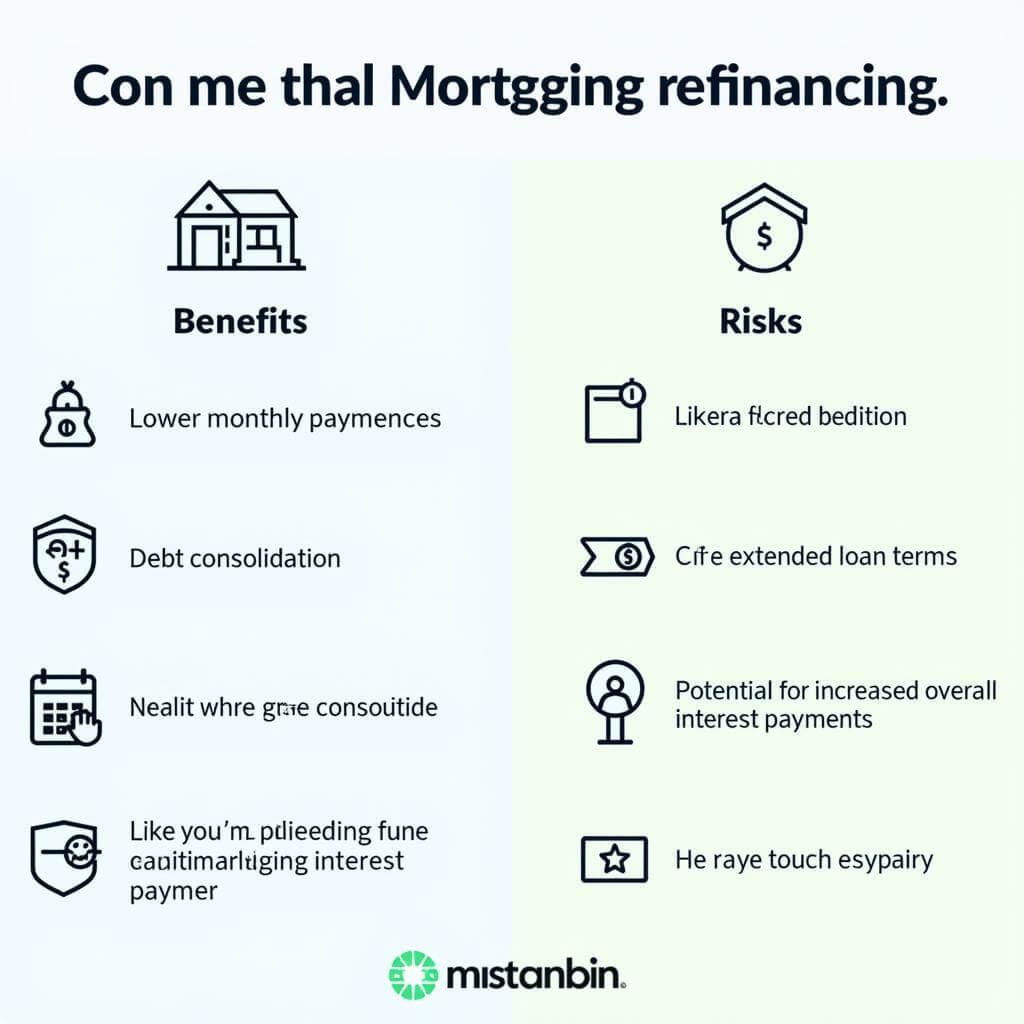

Some people believe that refinancing mortgages can help reduce household debt, while others argue it may lead to increased financial risk. Discuss both views and give your own opinion.

Analyzing the Question

This question requires candidates to:

- Understand the concept of mortgage refinancing and its relationship to household debt

- Present arguments for how refinancing can reduce debt

- Discuss potential financial risks associated with refinancing

- Provide a balanced discussion of both perspectives

- Form and express a personal opinion on the matter

Sample Essays

Band 8-9 Essay

In recent years, mortgage refinancing has become a popular financial strategy for homeowners seeking to manage their household debt. While some argue that this approach can effectively reduce overall debt burdens, others contend that it may expose individuals to greater financial risk. This essay will examine both perspectives before offering a nuanced opinion on the matter.

Proponents of mortgage refinancing assert that it can be a powerful tool for debt reduction. By securing a lower interest rate or extending the loan term, homeowners can significantly decrease their monthly payments. This freed-up cash flow can then be directed towards paying down high-interest debts such as credit card balances or personal loans. Moreover, some refinancing options allow homeowners to tap into their home equity, providing a lump sum that can be used to consolidate multiple debts into a single, more manageable payment.

However, critics argue that refinancing can potentially increase financial risk for households. Extending the loan term, while reducing monthly payments, often results in paying more interest over the life of the loan. Additionally, using home equity to pay off other debts puts one’s home at greater risk of foreclosure if financial circumstances change. There is also a danger that some individuals may view the reduced payments or cash-out options as an opportunity to accumulate more debt, rather than as a tool for financial stability.

In my opinion, the effectiveness of mortgage refinancing as a debt reduction strategy depends largely on individual circumstances and financial discipline. For those with a solid understanding of personal finance and a commitment to debt reduction, refinancing can indeed be a valuable tool. However, it is crucial that homeowners carefully consider the long-term implications and resist the temptation to use refinancing as a means to support unsustainable spending habits.

In conclusion, while mortgage refinancing offers potential benefits for reducing household debt, it is not without risks. The key to successful implementation lies in thorough financial planning, a clear understanding of the terms involved, and a disciplined approach to managing the resulting financial flexibility. Ultimately, refinancing should be viewed as one component of a comprehensive strategy for achieving long-term financial health, rather than a quick fix for debt problems.

(Word count: 367)

Band 6-7 Essay

Mortgage refinancing is a topic that many people are talking about these days when it comes to managing household debt. Some think it’s a good way to reduce debt, while others worry it might be risky. In this essay, I will discuss both sides of this argument and share my own thoughts.

Those who support refinancing mortgages believe it can help reduce debt in several ways. Firstly, if you can get a lower interest rate, your monthly payments will be smaller. This means you’ll have extra money each month that you can use to pay off other debts, like credit cards or loans. Also, some people use refinancing to get cash from their home’s value, which they can use to pay off high-interest debts all at once.

On the other hand, there are risks involved with refinancing that worry some people. One big concern is that if you extend your loan for a longer time, you might end up paying more interest overall, even if the monthly payments are lower. Another risk is that if you use your home’s value to pay off other debts, you could lose your house if you can’t make the payments later. Some people might also be tempted to spend more money or take on new debts if they suddenly have lower monthly payments.

In my opinion, whether refinancing is a good idea for reducing debt depends on each person’s situation. If someone is good with money and has a clear plan to pay off their debts, refinancing could be very helpful. But it’s important to think carefully about the long-term effects and not just focus on the short-term benefits.

To conclude, refinancing mortgages can be a useful tool for managing household debt, but it’s not without risks. People need to carefully consider their financial situation and future plans before deciding to refinance. It’s also important to get advice from financial experts to make sure it’s the right choice.

(Word count: 329)

Band 5-6 Essay

Many people are talking about mortgage refinancing as a way to deal with household debt. Some think it’s a good idea, but others say it can be dangerous. I will talk about both sides in this essay.

People who like refinancing say it can help reduce debt. If you get a better interest rate, you pay less money each month for your house. Then you can use the extra money to pay other debts. Some people also get money from their house value to pay big debts quickly.

But there are also problems with refinancing that make some people worried. If you make your loan longer, you might pay more money in total, even if you pay less each month. Also, if you use your house to pay other debts, you could lose your home if you can’t pay later. Some people might also spend more money if they have lower payments, which is not good.

I think refinancing can be good or bad depending on the person. If someone is good with money and wants to pay their debts, it could help. But people need to think carefully about what will happen in the future, not just now.

In the end, refinancing can help with debt, but it can also be risky. People should think hard about their money situation before they decide to refinance. It’s a good idea to talk to experts who know about money to make sure it’s the right thing to do.

(Word count: 249)

Explanation of Band Scores

Band 8-9 Essay

This essay demonstrates:

- Excellent grasp of the topic with sophisticated vocabulary (e.g., “nuanced opinion,” “financial stability”)

- Clear, logical structure with well-developed ideas

- Effective use of cohesive devices and complex sentence structures

- A balanced discussion with a well-reasoned personal opinion

- Appropriate use of topic-specific terms (e.g., “home equity,” “foreclosure”)

Band 6-7 Essay

This essay shows:

- Good understanding of the topic with some attempt at more sophisticated vocabulary

- Clear overall structure, though paragraphs are less well-developed than the Band 8-9 essay

- Some use of cohesive devices, with a mix of simple and complex sentences

- A balanced discussion with a personal opinion, though less nuanced than the higher band essay

- Adequate use of topic-specific terms, though less precise than the Band 8-9 essay

Band 5-6 Essay

This essay exhibits:

- Basic understanding of the topic with simpler vocabulary and sentence structures

- A clear attempt at organization, though ideas are less developed

- Limited use of cohesive devices, with mostly simple sentences

- A discussion of both views and a simple personal opinion

- Some attempt to use topic-specific terms, though with less accuracy and range

Key Vocabulary to Remember

- Mortgage refinancing (noun) – /ˈmɔːɡɪdʒ riːfaɪˈnænsɪŋ/ – The process of replacing an existing mortgage with a new one, typically with different terms

- Household debt (noun) – /ˈhaʊshoʊld det/ – The combined debt of all people in a household

- Financial risk (noun) – /faɪˈnænʃl rɪsk/ – The possibility of losing money in a financial decision or investment

- Home equity (noun) – /hoʊm ˈekwəti/ – The difference between the current market value of a home and the amount owed on the mortgage

- Foreclosure (noun) – /fɔːˈkloʊʒər/ – The process by which a lender takes possession of a property when the owner fails to make mortgage payments

- Cash flow (noun) – /kæʃ floʊ/ – The movement of money into and out of a business or household

- Consolidate (verb) – /kənˈsɒlɪdeɪt/ – To combine several debts or loans into one

- Financial stability (noun) – /faɪˈnænʃl stəˈbɪləti/ – The condition of having steady income and manageable debt

- Unsustainable (adjective) – /ˌʌnsəˈsteɪnəbl/ – Not able to be maintained at the current rate or level

- Long-term implications (noun phrase) – /lɒŋ tɜːm ˌɪmplɪˈkeɪʃnz/ – The effects or consequences that will be felt for a long time in the future

In conclusion, this topic on mortgage refinancing and household debt provides an excellent opportunity for IELTS candidates to demonstrate their ability to discuss complex financial concepts. While it may not be the most common subject in IELTS Writing Task 2, similar economic themes do appear regularly. To prepare effectively, practice writing essays on related topics such as personal finance management, economic policies affecting households, or the pros and cons of various debt reduction strategies. Remember to focus on clear structure, balanced arguments, and appropriate use of financial terminology. Feel free to write your own essay on this topic in the comments section for practice and potential feedback!