Tax policies and their impact on investment strategies are frequently featured topics in IELTS Writing Task 2 essays. Based on past exam trends, this subject is likely to appear in future tests due to its relevance in global economics and finance. Let’s explore a sample question and analyze high-scoring responses to help you excel in your IELTS preparation.

The effects of tax policies on investment strategies can be complex and far-reaching. Understanding these effects is crucial for both investors and policymakers. Let’s examine a typical IELTS Writing Task 2 question on this topic:

Some people believe that governments should use tax policies to encourage individuals and businesses to invest in environmentally friendly technologies. Others argue that tax incentives are not an effective way to promote green investments. Discuss both views and give your own opinion.

Analyzing the Question

This question requires candidates to:

- Discuss the pros of using tax policies to encourage green investments

- Explore the cons or limitations of such tax incentives

- Provide a personal opinion on the effectiveness of these policies

Now, let’s look at sample essays for different band scores.

Sample Essay 1 (Band 8-9)

In an era of increasing environmental concerns, the debate over using tax policies to promote green investments has gained significant traction. While some advocate for tax incentives as a powerful tool to drive eco-friendly technologies, others argue that such measures are ineffective. This essay will examine both perspectives before presenting my own viewpoint.

Proponents of tax incentives for green investments argue that financial motivation is a strong driver for both individuals and businesses. By offering tax breaks or deductions for investments in renewable energy, electric vehicles, or energy-efficient buildings, governments can make these options more attractive and affordable. This approach can accelerate the adoption of environmentally friendly technologies, potentially leading to a faster transition towards a sustainable economy. Moreover, such policies can create a ripple effect, stimulating innovation and job creation in the green technology sector.

However, critics contend that tax incentives alone are insufficient to drive meaningful change. They argue that the complexity of tax systems can make these incentives difficult to access, particularly for small businesses or individuals with limited financial literacy. Additionally, there’s a risk that such policies might primarily benefit wealthy individuals or large corporations who can afford substantial investments, potentially exacerbating economic inequality. Furthermore, some argue that the environmental impact of these incentives may be limited if they’re not part of a comprehensive sustainability strategy.

In my opinion, while tax incentives can be a valuable tool in promoting green investments, they should be part of a broader, multi-faceted approach to environmental policy. Tax policies can indeed influence investment decisions, but they need to be carefully designed to ensure accessibility and fairness. Complementary measures such as public education campaigns, regulatory standards, and direct government investments in green infrastructure are essential to create a holistic framework for sustainable development.

In conclusion, tax policies to encourage environmentally friendly investments have both merits and limitations. While they can provide a financial impetus for adopting green technologies, their effectiveness depends on thoughtful implementation and integration with other environmental initiatives. A balanced approach that combines fiscal incentives with other policy instruments is likely to yield the most significant impact in driving sustainable investments and addressing our pressing environmental challenges.

Tax incentives for green investments illustration

Tax incentives for green investments illustration

Sample Essay 2 (Band 6-7)

The use of tax policies to encourage green investments is a topic of debate. Some people think it’s a good idea, while others believe it’s not effective. This essay will discuss both views and give my opinion.

Those who support using tax policies for green investments say it can motivate people and companies to choose eco-friendly options. For example, if the government gives tax breaks for buying electric cars or installing solar panels, more people might do it because it saves them money. This could help reduce pollution and fight climate change. Also, it might create more jobs in green technology industries.

On the other hand, some people argue that tax incentives are not enough to make a real difference. They say that tax systems can be complicated, and not everyone understands how to use these benefits. There’s also a concern that only rich people or big companies can really take advantage of these tax breaks, which isn’t fair. Some critics also think that there are better ways to protect the environment, like making strict laws or investing directly in green projects.

In my opinion, tax policies can be helpful for promoting green investments, but they shouldn’t be the only solution. I think they can work well when combined with other strategies. For example, governments could use tax incentives along with education programs to teach people about environmental issues. They could also set rules for companies to follow and invest in public transportation or renewable energy projects.

To conclude, while tax policies for green investments have some advantages, they also have limitations. I believe a mix of different approaches, including tax incentives, is the best way to encourage environmentally friendly choices and address climate change.

Sample Essay 3 (Band 5-6)

Some people think governments should use tax policies to make people and businesses invest in green technologies. Other people think this is not a good way to do it. I will talk about both ideas and give my opinion.

People who like tax policies for green investments say it’s good because it makes people want to buy eco-friendly things. If you get a tax break for buying an electric car, you might want to buy one. This can help the environment and maybe make new jobs.

But some people don’t think this works well. They say tax rules are hard to understand, and only rich people or big companies can use them. They think there are better ways to help the environment, like making strong laws.

I think tax policies can help, but they are not enough alone. Governments should use tax breaks but also do other things like teaching people about the environment and making rules for companies.

In the end, tax policies for green investments have good and bad points. I think using them with other ideas is the best way to help the environment.

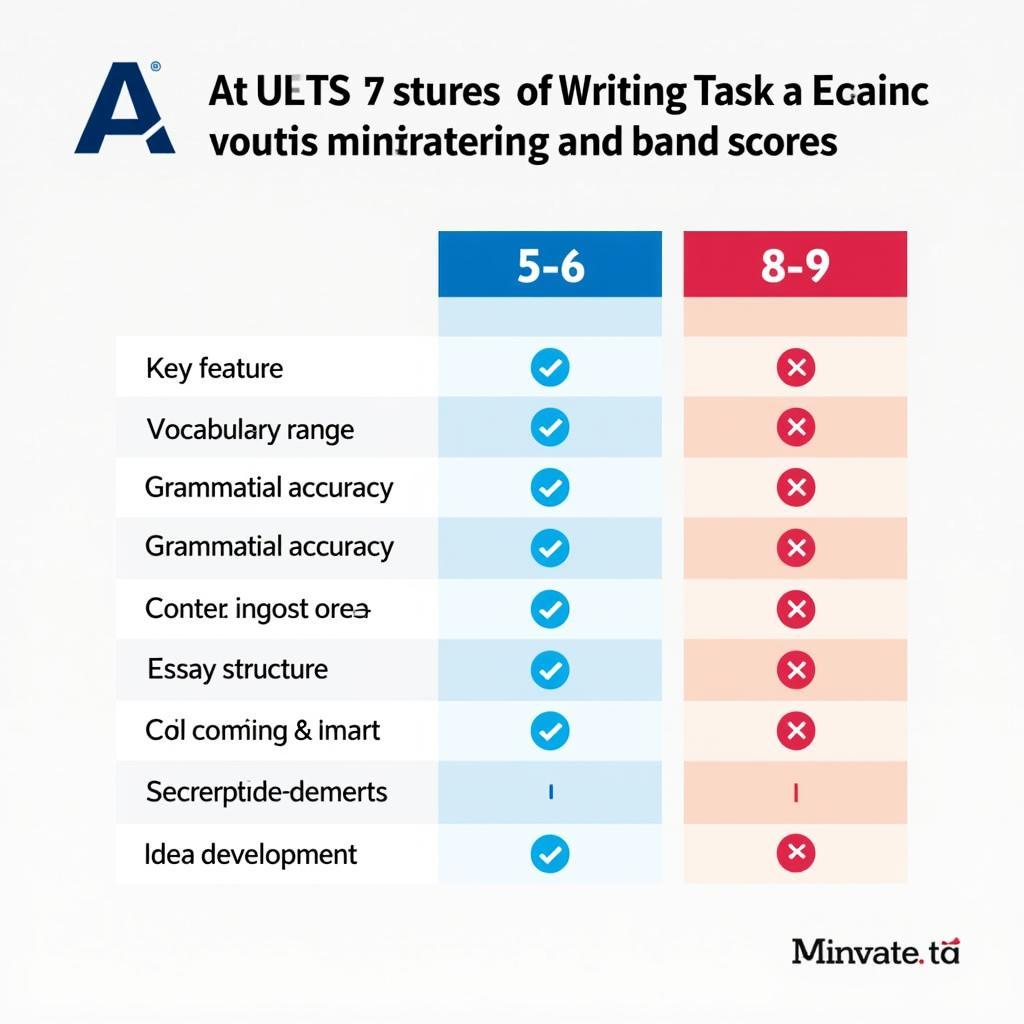

Explanation of Band Scores

Band 8-9 Essay:

- Fully addresses all parts of the task with a well-developed response

- Presents a clear position throughout the response

- Uses a wide range of vocabulary with very natural and sophisticated control

- Uses a wide range of structures with full flexibility and accuracy

- Has clear progression throughout with well-connected ideas

Band 6-7 Essay:

- Addresses all parts of the task, though some parts may be more fully covered than others

- Presents a relevant position, though the conclusions may become unclear or repetitive

- Uses an adequate range of vocabulary for the task, with some inaccuracies

- Uses a mix of simple and complex sentence forms

- Arranges information coherently with clear overall progression

Band 5-6 Essay:

- Addresses the task only partially, with limited development of ideas

- Expresses a position but the development is not always clear

- Uses a limited range of vocabulary, with some repetition and inappropriate word choice

- Uses a limited range of structures with some errors that may impede communication

- Presents information with some organization but there may be a lack of overall progression

Comparison of IELTS Writing Band Scores

Comparison of IELTS Writing Band Scores

Key Vocabulary to Remember

- Tax incentives (noun) – /tæks ɪnˈsentɪvz/ – Financial benefits offered through the tax system to encourage certain behaviors or investments

- Environmentally friendly (adjective) – /ɪnˌvaɪrənˈmentəli ˈfrendli/ – Not harmful to the environment

- Sustainable (adjective) – /səˈsteɪnəbəl/ – Able to be maintained at a certain rate or level without depleting natural resources

- Fiscal policy (noun) – /ˈfɪskəl ˈpɒləsi/ – Government policy regarding taxation and public spending

- Green technology (noun) – /griːn tekˈnɒlədʒi/ – Technology that is environmentally friendly

- Economic inequality (noun) – /ˌiːkəˈnɒmɪk ˌɪnɪˈkwɒləti/ – Difference in economic well-being between individuals or groups

- Comprehensive (adjective) – /ˌkɒmprɪˈhensɪv/ – Including or dealing with all or nearly all elements or aspects of something

- Multi-faceted (adjective) – /ˌmʌltiˈfæsɪtɪd/ – Having many different aspects or features

- Impetus (noun) – /ˈɪmpɪtəs/ – Something that makes a process or activity happen or happen more quickly

- Holistic (adjective) – /həˈlɪstɪk/ – Characterized by the belief that the parts of something are interconnected and can be explained only by reference to the whole

Conclusion

Understanding how taxes influence financial decision-making is crucial for tackling IELTS Writing Task 2 essays on tax policies and investment strategies. To further prepare, consider practicing with these potential future topics:

- The role of tax policies in reducing wealth inequality

- The impact of corporate tax rates on foreign direct investment

- Tax incentives for research and development in emerging technologies

Remember, the key to excelling in IELTS Writing Task 2 is practice. Try writing your own essay on the sample question provided and share it in the comments section for feedback. This active approach will help you refine your skills and boost your confidence for the actual test.