Debt management has been a recurring theme in IELTS Writing Task 2, appearing in various forms over the past decade. Based on analysis of past papers and current trends, questions about personal finance and debt management are likely to continue featuring prominently in future tests. Let’s examine some model essays exploring this crucial topic.

how to reduce debt through smart planning is becoming increasingly important as global household debt levels rise. This topic commonly appears in Task 2 questions focusing on economic issues and personal finance.

Question Analysis

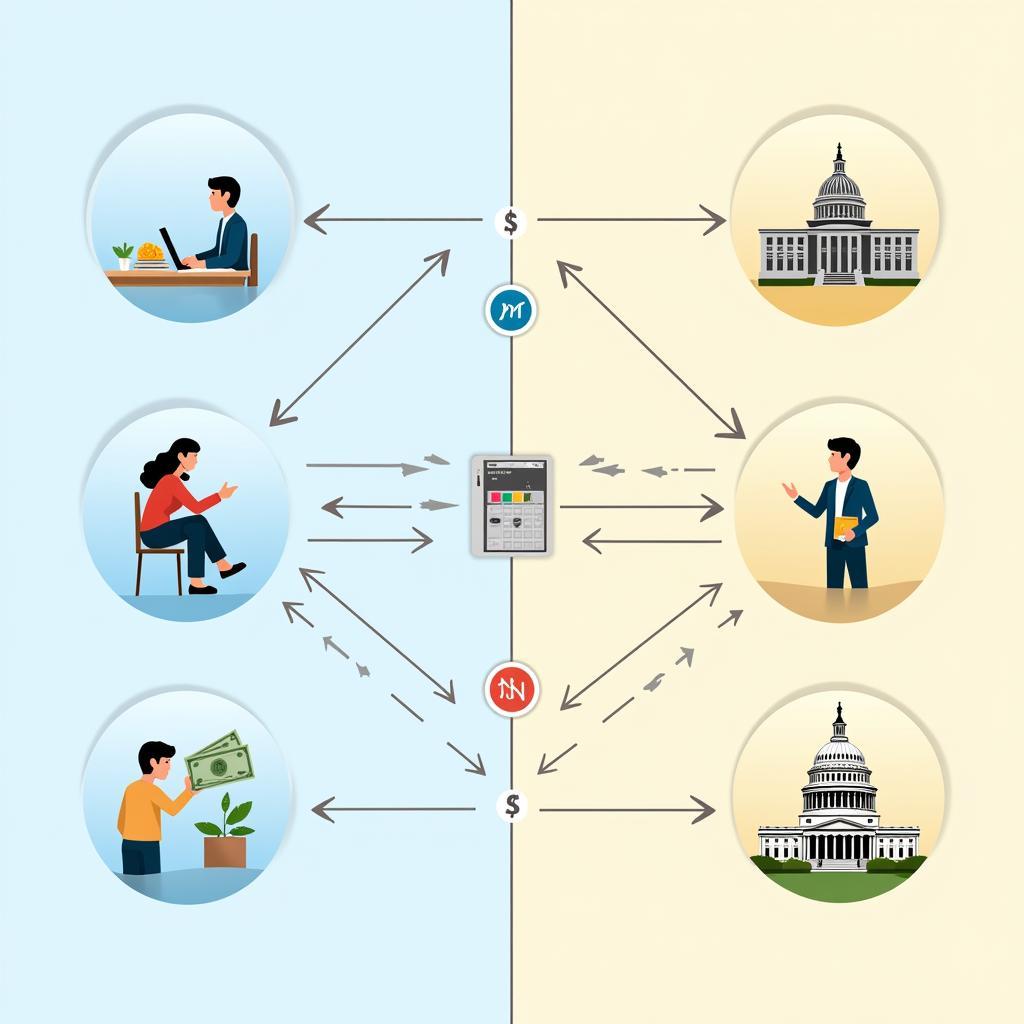

Some people believe that individuals should be solely responsible for managing their personal debt, while others think governments should provide more support and regulations to help people avoid excessive debt. Discuss both views and give your opinion.

This question requires:

- Discussion of two contrasting views on debt management

- Clear personal stance

- Relevant examples and explanations

- Balanced argument structure

Model Essay 1 (Band 8.5)

The management of personal debt has become a contentious issue, with debate centered on whether individuals or governments should bear primary responsibility. While both parties have important roles to play, I believe a balanced approach combining personal accountability with governmental oversight is most effective.

Those advocating for individual responsibility argue that personal debt management is fundamentally a private matter. They emphasize that individuals make their own financial decisions and should therefore face the consequences independently. Furthermore, they contend that government intervention might encourage reckless borrowing by creating an expectation of bailouts. This perspective aligns with importance of managing debts for financial growth, highlighting how personal responsibility drives financial literacy and prudent decision-making.

However, proponents of government involvement present compelling counterarguments. They point out that financial markets’ complexity often exceeds average citizens’ understanding, necessitating protective regulations. For instance, many countries have implemented mandatory financial education programs and established consumer protection agencies to prevent predatory lending practices. These measures have proven effective in reducing household debt levels and preventing financial crises.

In my view, the optimal approach combines both perspectives. While individuals must ultimately manage their finances responsibly, governments play a crucial role in creating a protective framework. This could include how to budget effectively for young families through educational initiatives and establishing clear lending guidelines. Such collaboration ensures both personal freedom and societal stability.

Model Essay 2 (Band 6.5)

Personal debt is a big problem in many countries today. Some people think individuals should handle their own debt problems, while others want the government to help more. I will discuss both views and give my opinion.

On one side, many people believe debt is a personal responsibility. They think each person should be careful with money and not expect others to help them if they have problems. Also, they say that government help might make people less careful with money because they think someone will always save them from trouble.

However, others say the government needs to do more to help people with debt. They think many financial products are too complicated for normal people to understand properly. The government can make rules to protect people from bad loans and teach them about money management. This view supports importance of reducing debt before investing.

I think both sides have good points, but the government should provide some help. While people need to be responsible, the government should make rules to protect them and give basic financial education. This way, everyone can make better choices about money.

Key Vocabulary (Essential for Task 2)

- Contentious (adj) /kənˈtenʃəs/ – causing disagreement or argument

- Predatory lending (n) /ˈpredəˌtɔri ˈlendɪŋ/ – unfair lending practices

- Financial literacy (n) /faɪˈnænʃəl ˈlɪtərəsi/ – understanding of financial matters

- Regulatory framework (n) /ˈregyəˌlətɔri ˈfreɪmwɜrk/ – system of regulations

- Fiscal responsibility (n) /ˈfɪskəl rɪˌspɒnsəˈbɪləti/ – careful management of money

Conclusion

Managing personal debt effectively requires both individual responsibility and appropriate government support. Future IELTS candidates should be prepared to discuss related topics such as:

- The role of financial education in schools

- Impact of digital banking on personal debt

- Government policies for protecting consumers from excessive debt

Practice writing your own essay on this topic and share it in the comments for feedback and discussion.