IELTS Writing Task 2 often includes topics related to finance and economics. One such topic that has appeared in recent years and is likely to continue being relevant is how to reduce risks in investing. This subject is particularly pertinent given the global economic uncertainties and the growing interest in personal finance among IELTS test-takers from countries like India, China, and Vietnam.

Let’s examine a question that closely mirrors those seen in actual IELTS exams:

Many people are now investing their money in the stock market or other financial products. What are the risks associated with this? How can these risks be reduced?

Analyzing the Question

This question consists of two parts:

- Identify the risks associated with investing in the stock market or other financial products.

- Suggest ways to reduce these risks.

To answer this effectively, candidates need to:

- Discuss various investment risks (e.g., market volatility, economic downturns, company-specific risks)

- Provide methods to mitigate these risks (e.g., diversification, research, long-term investing)

- Use relevant examples and personal knowledge to support their arguments

Now, let’s look at sample essays for different band scores.

Sample Essay for Band 8

Investing in financial markets has become increasingly popular as individuals seek to grow their wealth. However, this practice is not without its perils. This essay will discuss the primary risks associated with such investments and explore strategies to minimize these dangers.

The most significant risk in stock market investing is volatility. Share prices can fluctuate dramatically due to various factors, including economic conditions, political events, and company performance. For instance, the 2008 financial crisis saw global stock markets plummet, wiping out trillions in investor wealth. Another risk is the potential for company-specific issues, such as bankruptcy or fraud, which can lead to substantial losses for shareholders. Additionally, investors face the risk of making poor decisions due to lack of knowledge or emotional bias.

To mitigate these risks, several strategies can be employed. Firstly, diversification is crucial. By spreading investments across different sectors, asset classes, and geographical regions, investors can reduce their exposure to any single risk factor. This approach aligns with the principle of not putting all one’s eggs in one basket. Secondly, thorough research and continuous education about financial markets can help investors make more informed decisions and avoid potential pitfalls. This includes understanding a company’s fundamentals, industry trends, and broader economic indicators.

Furthermore, adopting a long-term investment horizon can help smooth out short-term market fluctuations. The long-term benefits of smart investing often outweigh short-term volatility. Additionally, using stop-loss orders and regularly rebalancing one’s portfolio can help manage risk. Finally, considering professional advice from financial advisors can provide valuable insights and help create a well-structured investment plan tailored to individual risk tolerance and financial goals.

In conclusion, while investing in financial markets carries inherent risks, these can be significantly reduced through careful planning and strategic approaches. By diversifying, educating oneself, maintaining a long-term perspective, and seeking professional guidance when necessary, investors can navigate the complexities of financial markets more safely and potentially reap the rewards of their investments.

Explanation for Band 8 Score

This essay would likely receive a Band 8 score for the following reasons:

-

Task Achievement: The essay fully addresses all parts of the task, discussing both the risks associated with investing and ways to reduce these risks.

-

Coherence and Cohesion: The essay is well-organized with clear progression throughout. It uses paragraphing effectively and employs a range of cohesive devices.

-

Lexical Resource: The essay demonstrates an impressive range of vocabulary, including financial terms like “volatility,” “diversification,” and “rebalancing.”

-

Grammatical Range and Accuracy: The essay uses a wide range of grammatical structures accurately. Complex sentences are used effectively without hindering communication.

-

Development and Support: Each main point is well-developed with relevant examples and explanations, such as referencing the 2008 financial crisis.

Sample Essay for Band 6-7

In recent years, many people have started investing their money in the stock market and other financial products. While this can be a good way to grow wealth, it also comes with risks. This essay will discuss these risks and some ways to reduce them.

One of the main risks of investing in the stock market is that prices can go up and down quickly. This means you could lose money if you need to sell your stocks when prices are low. Another risk is that a company you invest in might have problems or even go bankrupt, which could make your investment worthless. Also, some people make bad investment decisions because they don’t understand the market well enough.

To reduce these risks, there are several things investors can do. First, it’s important not to put all your money in one place. This is called diversification. For example, instead of buying stocks from just one company, you could buy stocks from different companies in different industries. This way, if one company does badly, you won’t lose all your money.

Another way to reduce risk is to learn more about investing before you start. This can help you make better decisions. You can read books, take classes, or talk to financial experts. It’s also a good idea to invest for the long term rather than trying to make quick profits. This can help you ride out the ups and downs of the market.

The impact of online investing platforms on retail investors has made it easier for people to start investing, but it’s important to be careful and not invest more than you can afford to lose. Some people also choose to use the services of a professional financial advisor who can help them make good investment choices.

In conclusion, while investing in the stock market and other financial products can be risky, there are ways to reduce these risks. By diversifying investments, learning about the market, and thinking long-term, people can potentially grow their wealth while managing the risks involved.

Explanation for Band 6-7 Score

This essay would likely receive a Band 6-7 score for the following reasons:

-

Task Achievement: The essay addresses all parts of the task, discussing both risks and ways to reduce them. However, the development of ideas is less thorough compared to the Band 8 essay.

-

Coherence and Cohesion: The essay is generally well-organized, but the use of cohesive devices is less sophisticated than in the Band 8 essay.

-

Lexical Resource: The essay uses some topic-specific vocabulary, but the range is more limited compared to the Band 8 essay. Some attempts at less common vocabulary are made.

-

Grammatical Range and Accuracy: The essay uses a mix of simple and complex sentence structures, with generally good control. However, the range is not as wide as in the Band 8 essay.

-

Development and Support: Main points are supported with examples, but these are less specific and detailed compared to the Band 8 essay.

Key Vocabulary to Remember

- Volatility (noun) – /ˌvɒləˈtɪləti/ – The tendency to change quickly and unpredictably

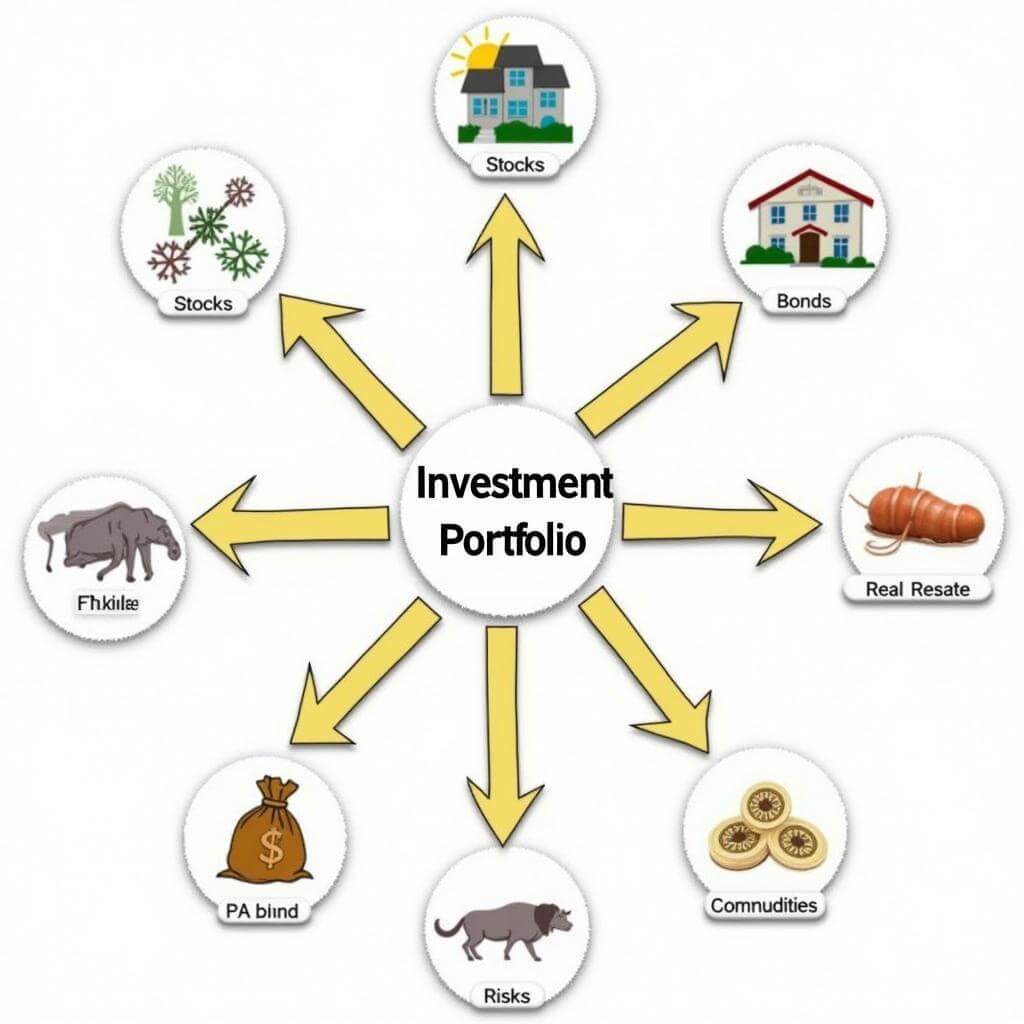

- Diversification (noun) – /daɪˌvɜːsɪfɪˈkeɪʃn/ – The action of spreading investments among different types of assets

- Portfolio (noun) – /pɔːtˈfəʊliəʊ/ – A range of investments held by a person or organization

- Asset allocation (noun) – /ˈæset ˌæləˈkeɪʃn/ – The process of dividing investments among different asset categories

- Rebalancing (noun) – /ˌriːˈbælənsɪŋ/ – The process of realigning the weightings of a portfolio of assets

- Risk tolerance (noun) – /rɪsk ˈtɒlərəns/ – The degree of variability in investment returns that an investor is willing to withstand

- Market downturn (noun) – /ˈmɑːkɪt ˈdaʊntɜːn/ – A general slowdown in economic activity

- Long-term perspective (noun) – /lɒŋ tɜːm pəˈspektɪv/ – A view of investment focused on future growth rather than short-term gains

In conclusion, the topic of reducing investment risks is highly relevant for IELTS Writing Task 2. To prepare effectively, practice writing essays on similar topics such as the impact of economic crises on personal finances, the role of financial literacy in modern society, or the role of ethical investing in financial markets. Remember to structure your essay clearly, use a range of vocabulary and grammatical structures, and support your points with relevant examples. Feel free to share your practice essays in the comments section for feedback and improvement.