Financial diversification is a crucial concept in modern investment strategies. This topic has appeared frequently in IELTS Writing Task 2 exams over the past few years, and its relevance is likely to increase in the future. Based on an analysis of past IELTS questions, we have identified a common essay prompt related to this subject:

Some people believe that it is important to have a wide range of investments to reduce financial risk. Others think it is better to focus on one or two areas of investment. Discuss both views and give your own opinion.

Let’s analyze this question and provide sample essays for different band scores.

Question Analysis

This question falls under the “discuss both views and give your opinion” category. It requires candidates to:

- Explain why some people believe in diversifying investments

- Discuss the reasons others prefer focusing on fewer investment areas

- Provide a personal opinion with supporting arguments

The key challenge is to present balanced arguments for both viewpoints before concluding with a well-supported personal stance.

Sample Essay 1 (Band 8-9)

In the realm of financial management, the debate between diversification and focused investment strategies continues to be a topic of significant discussion. While some individuals advocate for a broad investment portfolio to mitigate risks, others argue for concentrating resources in specific areas. This essay will examine both perspectives before presenting my own viewpoint.

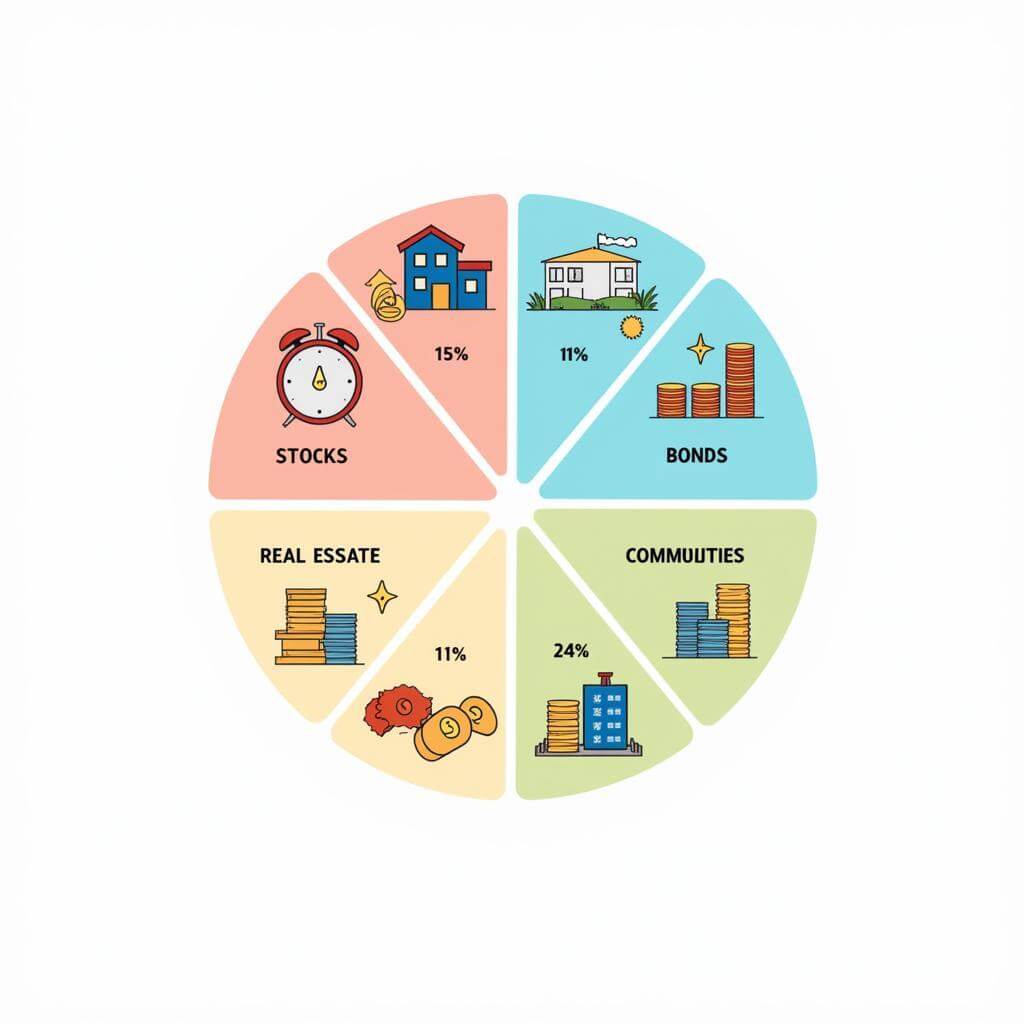

Proponents of diversification argue that spreading investments across various sectors and asset classes can significantly reduce overall financial risk. This approach is based on the principle of not “putting all your eggs in one basket.” By investing in a mix of stocks, bonds, real estate, and other financial instruments, individuals can potentially offset losses in one area with gains in another. For instance, during an economic downturn, while stocks might underperform, bonds or precious metals could provide stability to the portfolio. This strategy is particularly appealing to risk-averse investors or those nearing retirement age who prioritize capital preservation.

On the other hand, advocates of focused investments contend that concentrating resources in one or two areas can yield higher returns and allow for more effective management. They argue that by specializing in specific sectors or investment types, individuals can develop deep expertise and make more informed decisions. For example, a person focusing solely on technology stocks might have a better understanding of market trends and company potentials in that sector, potentially leading to more profitable investment choices. Additionally, managing a smaller portfolio can be less time-consuming and may incur lower transaction costs.

In my opinion, while both strategies have their merits, a balanced approach leaning towards diversification is generally more beneficial for most investors. The primary advantage of diversification is its ability to provide a safety net against unforeseen market fluctuations and economic crises. However, I believe that within a diversified portfolio, it is still possible and often advisable to have areas of focus or concentration based on an individual’s expertise or interests. This hybrid approach can offer the risk mitigation benefits of diversification while still allowing for potentially higher returns in specific areas of competence.

In conclusion, the choice between diversification and focused investments should be tailored to an individual’s financial goals, risk tolerance, and market knowledge. While diversification offers broader protection against market volatility, a degree of focused investment within a diversified portfolio can provide a balanced approach to managing financial risks and opportunities.

[Word count: 377]

Sample Essay 2 (Band 6-7)

In today’s financial world, people have different opinions about how to invest money. Some think it’s good to invest in many different things, while others prefer to focus on just a few areas. This essay will discuss both ideas and give my opinion.

Many people believe that investing in different areas is a good idea. They think this way because it can help reduce the risk of losing all their money. For example, if someone invests in stocks, bonds, and real estate, they might not lose everything if one of these investments fails. This is like not putting all your eggs in one basket. It can make people feel safer about their money, especially if they don’t want to take big risks.

However, other people think it’s better to focus on one or two types of investments. They believe that by concentrating on fewer areas, they can become experts in those fields. This might help them make better decisions and earn more money. For instance, someone who only invests in technology companies might understand that market very well and make smart choices. Also, managing fewer investments can be easier and take less time.

In my opinion, I think it’s generally better to have a mix of different investments. This is because it can help protect your money from big losses if one type of investment does badly. However, I also think it’s good to have some areas where you invest more because you know a lot about them. This way, you can try to get the benefits of both methods.

To conclude, both ways of investing have good points. Investing in many areas can be safer, while focusing on a few can sometimes make more money. I believe the best approach is to have a mix of different investments but also to focus more on areas you understand well.

[Word count: 309]

Sample Essay 3 (Band 5-6)

Some people think it’s important to invest money in many different things, but others believe it’s better to focus on just one or two areas. In this essay, I will talk about both ideas and give my opinion.

Investing in many different things can be good because it can help protect your money. If you put all your money in one place and that investment fails, you could lose everything. But if you spread your money around, you might not lose as much. For example, if you invest in stocks, property, and gold, you have a better chance that at least one of these will do well.

On the other hand, some people think it’s better to focus on just a few investments. They believe that if you concentrate on one or two areas, you can become very knowledgeable about them. This might help you make better choices and earn more money. Also, it can be easier to manage fewer investments.

In my opinion, I think it’s usually better to invest in different things. This is because it seems safer and less risky. However, I also think it’s good to know a lot about the areas where you invest your money. So, maybe the best way is to have several different investments but to learn a lot about each one.

To sum up, both ways of investing have good points. Investing in many areas can be safer, while focusing on a few can sometimes make more money. I think the best idea is to try to do both – invest in different things but also try to become knowledgeable about each investment.

[Word count: 266]

Explanation of Band Scores

Band 8-9 Essay

This essay demonstrates excellent writing skills and a sophisticated approach to the topic:

- Task Response: The essay fully addresses all parts of the task, presenting a well-developed response with relevant, extended, and supported ideas.

- Coherence and Cohesion: Ideas are logically organized with clear progression throughout. Paragraphs are well-linked, and cohesive devices are used effectively.

- Lexical Resource: A wide range of vocabulary is used with very natural and sophisticated control of lexical features. Rare minor errors occur only as ‘slips’.

- Grammatical Range and Accuracy: A wide range of structures is used with full flexibility and accuracy. Grammar and punctuation are used consistently and accurately.

Band 6-7 Essay

This essay shows a competent handling of the task with some limitations:

- Task Response: All parts of the task are addressed, though some parts may be more fully covered than others.

- Coherence and Cohesion: Information and ideas are generally arranged coherently, and there is a clear overall progression.

- Lexical Resource: An adequate range of vocabulary is used for the task. There may be some inaccuracies in word choice or spelling, but these do not impede communication.

- Grammatical Range and Accuracy: A mix of simple and complex sentence forms is used. There are some errors in grammar and punctuation, but these rarely reduce communication.

Band 5-6 Essay

This essay demonstrates a modest attempt at addressing the task:

- Task Response: The essay addresses the task only partially, with limited development of ideas.

- Coherence and Cohesion: The overall structure is evident but not always logical. Basic cohesive devices are used, but connections between ideas may be unclear or awkward.

- Lexical Resource: A limited range of vocabulary is used, with some repetition and occasional inaccuracies in word choice.

- Grammatical Range and Accuracy: A limited range of structures is used. Errors in grammar and punctuation occur, but the meaning is generally clear.

Key Vocabulary

-

Diversification (noun) – /daɪˌvɜːsɪfɪˈkeɪʃn/ – The practice of varying investments within a portfolio to limit exposure to any single asset or risk.

-

Portfolio (noun) – /pɔːtˈfəʊliəʊ/ – A collection of investments held by an individual or organization.

-

Risk mitigation (noun phrase) – /rɪsk ˌmɪtɪˈɡeɪʃn/ – The process of reducing the likelihood or impact of potential risks.

-

Asset allocation (noun phrase) – /ˈæset ˌæləˈkeɪʃn/ – The strategy of dividing investments among different asset categories.

-

Volatility (noun) – /ˌvɒləˈtɪləti/ – The degree of variation of a trading price series over time.

-

Capital preservation (noun phrase) – /ˈkæpɪtl ˌprezəˈveɪʃn/ – A conservative investment strategy aimed at preventing loss of initial capital.

-

Market fluctuations (noun phrase) – /ˈmɑːkɪt ˌflʌktʃuˈeɪʃnz/ – Changes in the price or value of a market or security.

-

Risk tolerance (noun phrase) – /rɪsk ˈtɒlərəns/ – The degree of variability in investment returns that an investor is willing to withstand.

-

Sector specialization (noun phrase) – /ˈsektə ˌspeʃəlaɪˈzeɪʃn/ – The practice of focusing investments or expertise on a particular industry or market sector.

-

Hybrid approach (noun phrase) – /ˈhaɪbrɪd əˈprəʊtʃ/ – A strategy that combines elements of different investment philosophies or methods.

Conclusion

The importance of diversification in financial investments is a crucial topic in IELTS Writing Task 2. Understanding both the benefits of diversification and the arguments for focused investments is essential for crafting a well-balanced essay. As you prepare for your IELTS exam, consider practicing with similar prompts, such as:

-

“Some experts argue that financial education should focus on teaching diversification strategies. Others believe it’s more important to learn about specific investment types in depth. Discuss both views and give your opinion.”

-

“In an increasingly globalized economy, some people believe international investment diversification is crucial. Others think focusing on domestic markets is safer. Discuss both views and give your opinion.”

We encourage you to practice writing essays on these topics and share them in the comments section below. This active practice can significantly improve your writing skills and prepare you for success in the IELTS Writing Task 2.

importance of having diverse financial portfolios is a key concept in modern financial planning. As you continue to explore this topic, consider how importance of financial advisors for personal growth can play a role in developing effective investment strategies. Additionally, understanding the importance of investing in mutual funds can provide valuable insights into diversification practices.

Remember, mastering IELTS Writing Task 2 requires consistent practice and a deep understanding of various topics. Good luck with your IELTS preparation!