The topic of early retirement savings has become increasingly prevalent in IELTS Writing Task 2 exams. Based on recent trends and the growing global emphasis on financial planning, it’s likely that this theme will continue to appear frequently in future tests. To help you prepare, we’ve selected a relevant question that closely resembles past exam topics:

Many people believe that individuals should start saving for retirement as early as possible in their careers. To what extent do you agree or disagree with this view?

Let’s analyze this question and provide sample essays for different band scores.

Question Analysis

This question asks for your opinion on the importance of saving for retirement early. Key points to consider:

- The main topic is early retirement savings.

- You need to express your level of agreement or disagreement.

- You should discuss reasons for your stance and provide relevant examples.

- Consider both sides of the argument before reaching a conclusion.

Sample Essay 1 (Band 8-9)

In today’s fast-paced world, the notion of early retirement planning has gained significant traction. I strongly agree with the view that individuals should commence saving for their retirement as soon as they begin their careers, and I will elucidate my reasons in this essay.

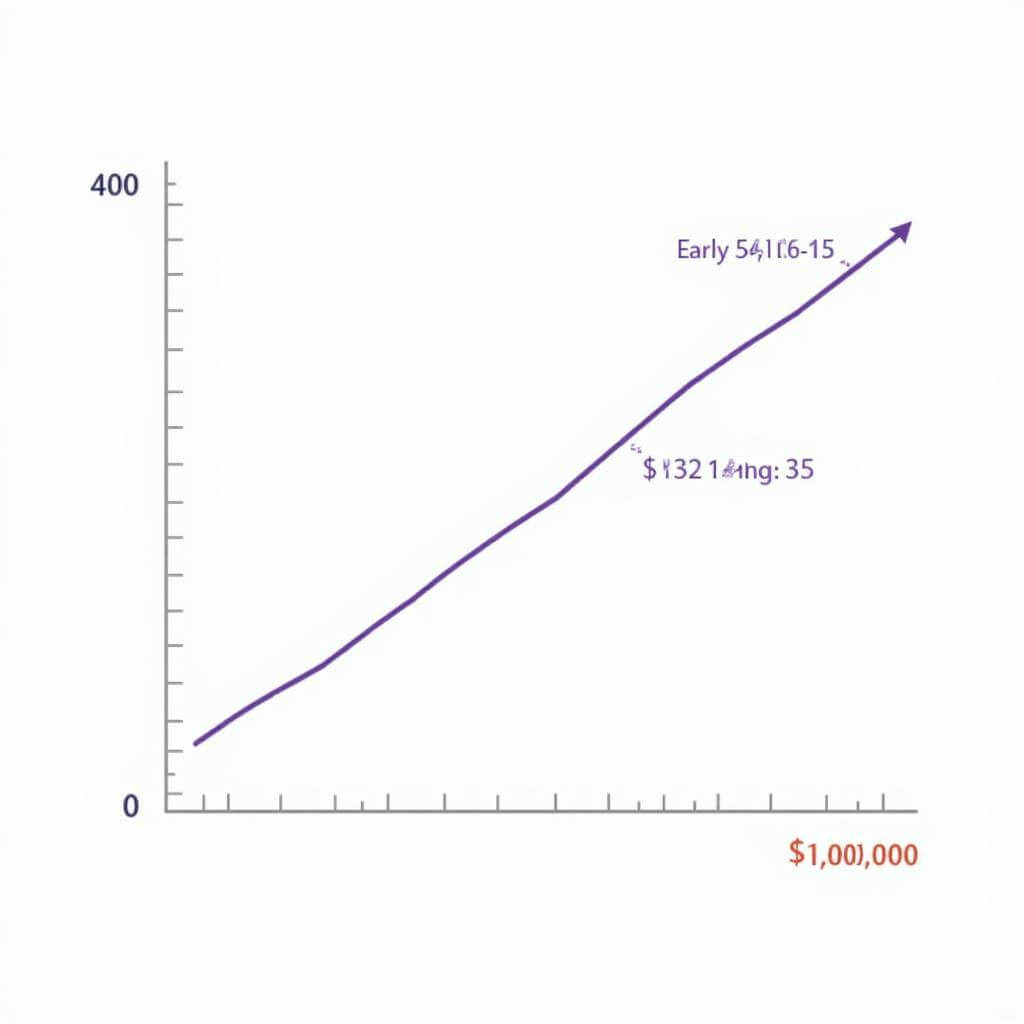

Firstly, the power of compound interest cannot be overstated when it comes to long-term savings. By starting early, even small contributions can grow substantially over time. For instance, a 25-year-old who invests $5,000 annually for 40 years could potentially accumulate over $1 million by retirement, assuming an average annual return of 7%. This demonstrates how time can be a powerful ally in wealth accumulation.

Moreover, early retirement saving fosters financial discipline and security. Young professionals who cultivate the habit of setting aside a portion of their income for the future are more likely to develop responsible financial behaviors. This practice not only ensures a comfortable retirement but also provides a safety net for unforeseen circumstances, aligning with the importance of saving for emergencies.

Furthermore, early savers have more flexibility in their investment strategies. They can afford to take calculated risks with potentially higher returns, as they have ample time to recover from market fluctuations. This advantage is particularly crucial in times of economic uncertainty, such as periods of high inflation, where best savings strategies during high inflation become essential.

However, it is important to acknowledge that some may argue against early retirement saving, citing the need to focus on immediate financial goals or enjoy one’s youth. While these concerns are valid, I believe a balanced approach can address both present and future needs. Young adults can allocate a portion of their income to retirement while still having resources for current expenses and leisure activities.

In conclusion, the benefits of early retirement saving far outweigh any potential drawbacks. By harnessing the power of compound interest, developing financial discipline, and maximizing investment flexibility, individuals can secure a comfortable future while still enjoying their present. As such, I firmly believe that starting to save for retirement at the outset of one’s career is a wise and prudent decision.

Sample Essay 2 (Band 6-7)

In recent years, there has been a growing belief that people should begin saving for their retirement as soon as they start working. I agree with this idea to a large extent, and I will explain why in this essay.

One of the main reasons for starting to save early is that it gives you more time to save money. When you start saving in your 20s or 30s, you have many years ahead of you to put money aside. This means you can save smaller amounts each month but still end up with a large sum by the time you retire. For example, if you save $200 per month for 40 years, you will have much more money than if you save $400 per month for just 20 years.

Another advantage of early retirement saving is that it helps you develop good financial habits. When you get used to saving a part of your income from a young age, it becomes a normal part of your life. This can help you manage your money better in other areas too, like saving for major life events or emergencies.

However, some people might say that it’s hard to save for retirement when you’re young because you don’t earn much money and have other expenses. This is a fair point, but I think even saving a small amount is better than not saving at all. You can start with a little and increase it as your income grows.

In conclusion, I believe that starting to save for retirement early in your career is a very good idea. It gives you more time to save and helps you become better at managing your money. While it may be challenging for some young people, the long-term benefits make it worthwhile.

Sample Essay 3 (Band 5-6)

Many people think we should start saving money for when we stop working as soon as we get our first job. I mostly agree with this idea and will say why.

Firstly, saving early means more money later. If we save for a long time, our money grows more. This is because banks give us extra money (interest) for keeping our money with them. The longer we save, the more extra money we get.

Also, saving early is a good habit. When we start saving young, we learn how to use money well. This can help us with other money things too, like saving for a house or children’s education.

But some people might say it’s hard to save when you’re young because you don’t have much money. This is true, but I think we can save even a little bit. It’s better than not saving at all.

In conclusion, I think saving for retirement early is a good idea. It helps us have more money when we’re old and teaches us good money habits. Even if it’s hard, we should try to save a little when we’re young.

Explanation of Band Scores

Band 8-9 Essay:

- Task Achievement: Fully addresses all parts of the task with a clear position and well-developed ideas.

- Coherence and Cohesion: Logically organized with a clear progression of ideas and effective use of cohesive devices.

- Lexical Resource: Wide range of vocabulary used accurately and appropriately, including topic-specific terms.

- Grammatical Range and Accuracy: Variety of complex structures used accurately, with only rare minor errors.

Band 6-7 Essay:

- Task Achievement: Addresses all parts of the task, though some aspects may be more fully covered than others.

- Coherence and Cohesion: Clear overall progression, but may lack some cohesion between ideas.

- Lexical Resource: Adequate range of vocabulary with some attempts at less common words.

- Grammatical Range and Accuracy: Mix of simple and complex sentences with some errors that do not impede communication.

Band 5-6 Essay:

- Task Achievement: Addresses the task, but may be incomplete or lack focus in parts.

- Coherence and Cohesion: Basic organization is apparent, but connections between ideas may be unclear at times.

- Lexical Resource: Limited range of vocabulary, with some inaccuracies in word choice or form.

- Grammatical Range and Accuracy: Attempts complex sentences but with frequent grammatical errors.

Key Vocabulary

-

Compound interest (noun) – /ˈkɒmpaʊnd ˈɪntrəst/ – Interest calculated on the initial principal and accumulated interest.

-

Financial discipline (noun phrase) – /faɪˈnænʃəl ˈdɪsəplɪn/ – The practice of managing money and expenses in a controlled and effective manner.

-

Investment strategy (noun phrase) – /ɪnˈvestmənt ˈstrætədʒi/ – A plan for allocating investments to achieve financial goals.

-

Economic uncertainty (noun phrase) – /ˌiːkəˈnɒmɪk ʌnˈsɜːtənti/ – Unpredictability in economic conditions or outcomes.

-

Financial habits (noun phrase) – /faɪˈnænʃəl ˈhæbɪts/ – Regular practices or tendencies in managing personal finances.

-

Retirement planning (noun phrase) – /rɪˈtaɪəmənt ˈplænɪŋ/ – The process of determining retirement income goals and actions to achieve them.

-

Long-term benefits (noun phrase) – /lɒŋ tɜːm ˈbenɪfɪts/ – Advantages or positive outcomes that are realized over an extended period.

In conclusion, the importance of early retirement savings cannot be overstated. As demonstrated in the sample essays, starting to save early in one’s career offers numerous advantages, including the power of compound interest, development of good financial habits, and increased flexibility in investment strategies. While challenges may arise, particularly for young professionals balancing various financial priorities, the long-term benefits of early saving far outweigh the short-term difficulties.

To further practice this topic, consider writing your own essay addressing the following question:

“Some people argue that saving for retirement should be mandatory for all workers. Do you agree or disagree with this view?”

Feel free to share your essay in the comments section below for feedback and discussion. Remember, consistent practice is key to improving your IELTS Writing skills!