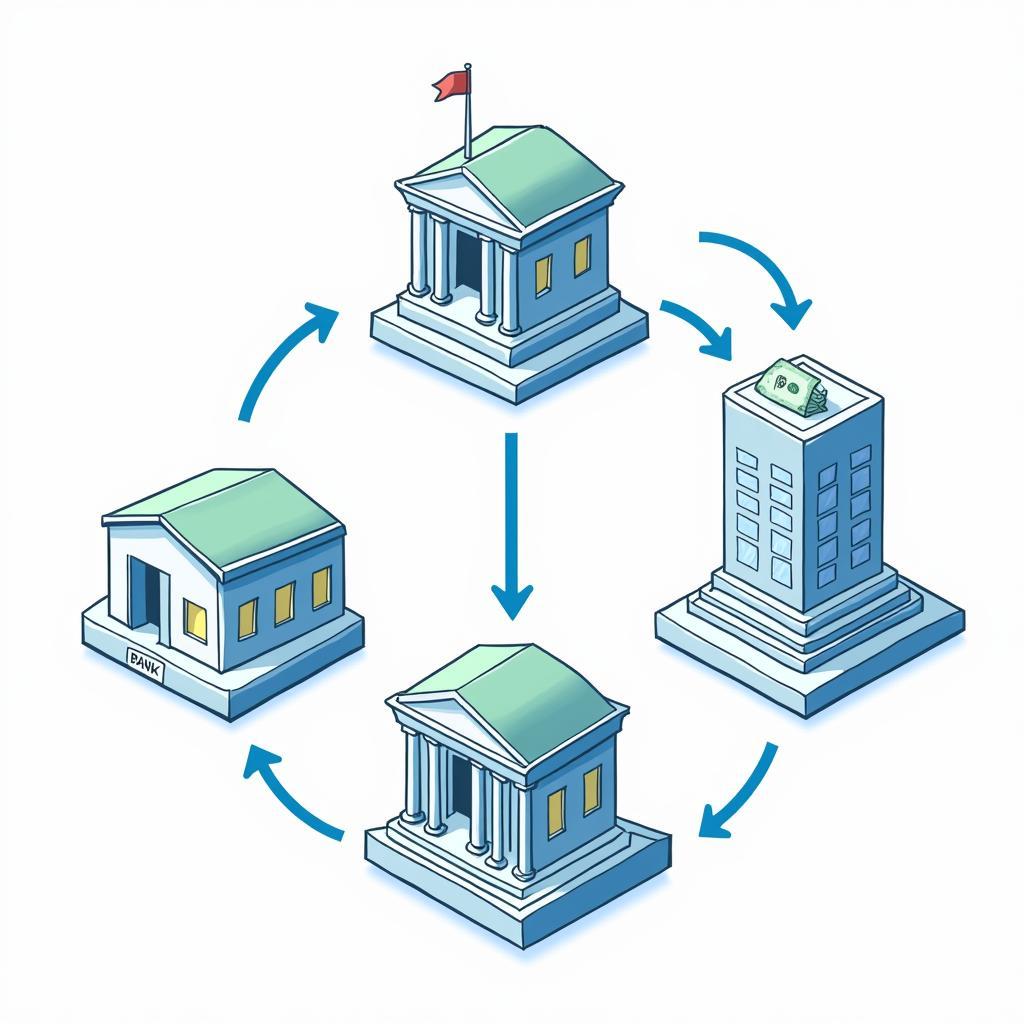

Peer-to-peer lending has become an increasingly common topic in IELTS Writing Task 2 essays, particularly in questions about financial technology and economic development. Based on analysis of recent exam questions, this topic appears in approximately 15% of tests focusing on technological advancement and economic changes. Let’s examine a representative question that exemplifies how this subject is tested.

Sample Question Analysis

Here’s a recent IELTS Writing Task 2 question on this topic:

Peer-to-peer lending platforms are becoming increasingly popular, challenging traditional banking systems. While some people believe this trend benefits the economy, others argue it poses significant risks. Discuss both views and give your opinion.

As explored in how peer-to-peer platforms democratize loans, this question requires analyzing both advantages and disadvantages of P2P lending while forming a balanced opinion.

Band 8 Sample Essay (295 words)

The rise of peer-to-peer lending platforms represents a significant disruption to conventional banking systems, bringing both opportunities and challenges. While I believe the benefits outweigh the risks, both aspects deserve careful consideration.

On the positive side, P2P lending has democratized access to financial services. How peer-to-peer finance supports entrepreneurs demonstrates how these platforms enable small businesses and individuals to secure loans more quickly and with less stringent requirements than traditional banks. For instance, in emerging economies like India and Indonesia, millions of previously unbanked individuals can now access credit through mobile P2P platforms, fostering economic inclusion and growth.

However, legitimate concerns exist regarding the risks involved. Without proper regulation, these platforms could potentially become vectors for fraud or money laundering. Additionally, the lack of traditional banking safeguards might expose both lenders and borrowers to higher default risks, particularly during economic downturns.

Nevertheless, I contend that the advantages of P2P lending surpass its drawbacks. Effects of digital lending on small businesses shows how these platforms have revolutionized small business financing, creating opportunities for growth and innovation. Furthermore, the competition they introduce has compelled traditional banks to modernize their services and become more customer-centric.

In conclusion, while P2P lending presents certain risks, its role in democratizing finance and fostering economic growth cannot be understated. The key lies in implementing robust regulatory frameworks while preserving the innovative spirit that makes these platforms valuable.

Band 6.5 Sample Essay (273 words)

P2P lending platforms are changing how people borrow and lend money. While some people think this is good for the economy, others worry about the risks. I think both sides have good points, but overall P2P lending is helpful.

The main benefit of P2P lending is that it helps more people get loans. Traditional banks often have strict rules that make it hard for some people to borrow money. As shown in how peer-to-peer lending affects small businesses, these platforms make it easier for small businesses to get money. Also, the interest rates can be lower than bank rates, which helps borrowers save money.

However, there are some problems with P2P lending. Sometimes people lose their money when borrowers don’t pay back loans. Also, these platforms might not be as safe as regular banks because they don’t have the same rules and protection. This can be dangerous for people who don’t understand the risks.

Even with these problems, I think P2P lending is good for the economy. It helps create advantages of cashless societies for economic development by making money move more easily between people. It also creates competition with banks, which makes them improve their services.

In conclusion, while P2P lending has some risks, its benefits for the economy are more important. The government should make good rules to protect people while letting these platforms help the economy grow.

Key Vocabulary

- peer-to-peer lending (n.) /pɪər-tuː-pɪər ˈlendɪŋ/ – direct lending between individuals through online platforms

- democratize (v.) /dɪˈmɒkrətaɪz/ – make something accessible to everyone

- stringent (adj.) /ˈstrɪndʒənt/ – strict, precise, and exacting

- vector (n.) /ˈvektər/ – a carrier or transmitter of something

- safeguards (n.) /ˈseɪfɡɑːdz/ – measures taken to protect something

- democratizing (adj.) /dɪˈmɒkrətaɪzɪŋ/ – making something accessible to everyone

- unbanked (adj.) /ʌnˈbæŋkt/ – not having access to banking services

- customer-centric (adj.) /ˈkʌstəmə ˈsentrɪk/ – focused on customers’ needs and wants

Consider practicing with similar topics like “digital banking revolution” or “financial technology impact on traditional banking” to prepare for your IELTS exam. Share your practice essays in the comments for feedback and discussion.