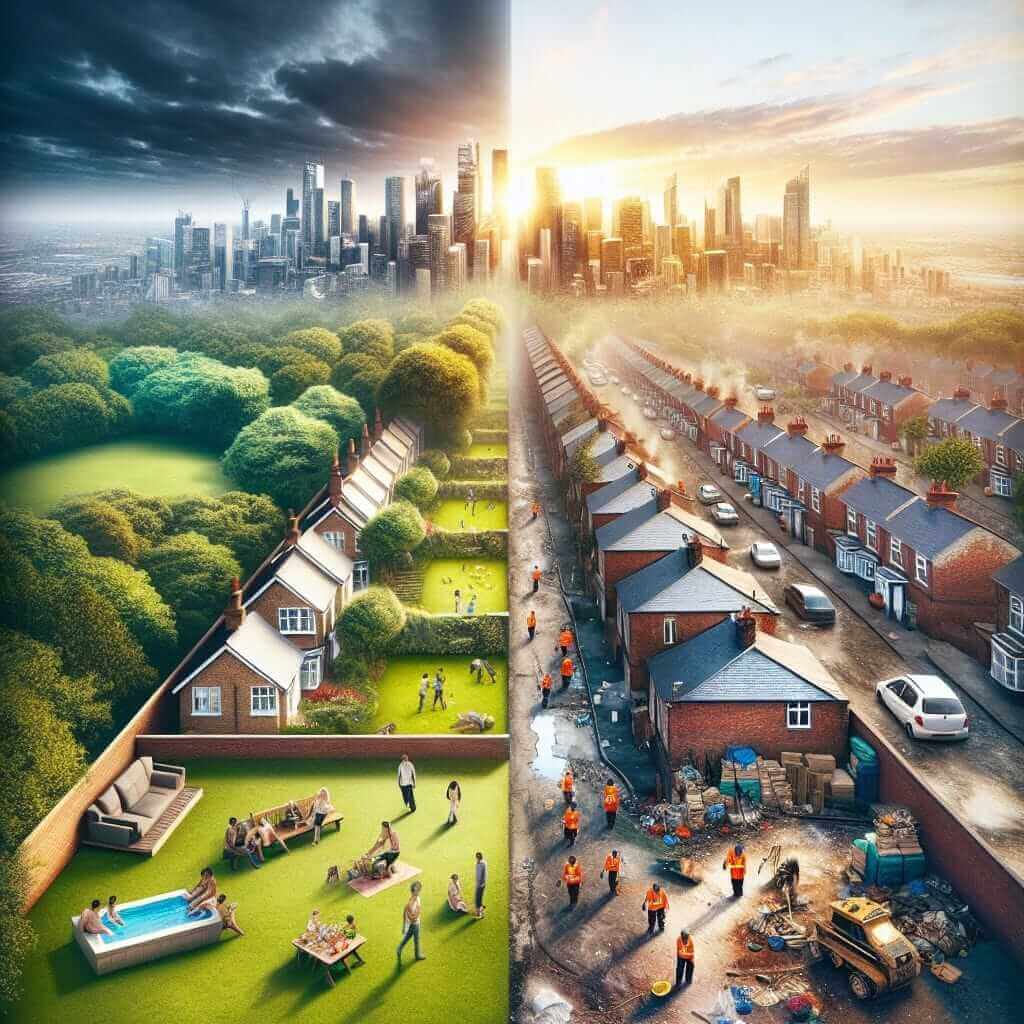

Income inequality is a critical issue that can affect social harmony and economic stability. In the context of economic policies, this topic can be highly relevant for the IELTS Writing Task 2 exam, often appearing in prompts that require candidates to explore the impact of government policies on various aspects of society.

Exploring the Topic and Creating Prompts

Economic policies can include a range of measures such as tax reforms, social welfare programs, minimum wage legislation, and trade policies. The incidence of these policies on income distribution can be profound. Below are some potential IELTS Writing Task 2 prompts related to the impact of economic policies on income inequality:

- “To what extent do government economic policies contribute to income inequality in modern societies? Discuss both views and give your own opinion.”

- “Some people believe that economic policies designed to reduce income inequality are essential for social stability. Others argue that such policies can be detrimental to economic growth. Discuss both views and give your own opinion.”

- “Is it more effective for governments to implement social welfare programs or to focus on economic growth to reduce income inequality? Discuss and provide examples to support your view.”

Selecting a Prompt and Analyzing It

Chosen Prompt:

“Some people believe that economic policies designed to reduce income inequality are essential for social stability. Others argue that such policies can be detrimental to economic growth. Discuss both views and give your own opinion.”

Analyzing the Prompt:

This prompt requires you to:

- Explain the viewpoint that economic policies aimed at reducing income inequality are crucial for maintaining social stability.

- Discuss the opposing view that such policies might hinder economic growth.

- Provide your own opinion on the matter.

Writing a Sample Essay

Introduction

Income inequality and its mitigation through economic policies are hotly debated. Some assert that economic measures to curb income inequality are paramount for maintaining social cohesion, whereas others contend that such policies may impede economic advancement. This essay will discuss both viewpoints before arriving at a reasoned conclusion.

Body Paragraph 1: Viewpoint Supporting Economic Policies to Reduce Income Inequality

Proponents of economic policies targeting income disparity argue that reducing income inequality fosters social stability. By implementing tax reforms and welfare programs, governments can ensure a more equitable distribution of wealth, contributing to decreased social tensions and a more cohesive society. For instance, progressive taxation, wherein higher income groups are taxed at higher rates, can be used to fund public services and social welfare programs, thereby diminishing economic disparities. Furthermore, policies such as minimum wage legislation and unemployment benefits support low-income individuals, preventing extreme poverty and associated social unrest.

Body Paragraph 2: Viewpoint Against Economic Policies to Reduce Income Inequality

Conversely, critics argue that economic policies aimed at reducing income inequality may stifle economic growth. They claim that heavy taxation on the wealthy and excessive public spending can disincentivize investment and innovation. High taxes on corporations, for example, might result in reduced profits and lower reinvestment in business expansion, leading to slower economic growth. Additionally, excessive social welfare programs could potentially reduce the incentive for individuals to work, resulting in decreased productivity. The debate thus centers on finding a balance between equity and economic efficiency.

Body Paragraph 3: Own Opinion

In my view, while economic policies should certainly strive to reduce income inequality to some extent, they must be carefully designed to avoid hindering economic growth. A balanced approach, involving moderate taxation and well-targeted social welfare programs, can help mitigate income disparities without significantly impairing economic advancement. For instance, investing in education and healthcare can enhance human capital, promoting both equity and long-term economic development. Therefore, targeted policies that promote inclusivity while ensuring economic dynamism present the most viable solution.

Conclusion

In conclusion, economic policies designed to curtail income inequality are vital for social stability but must be implemented judiciously to avoid detrimental effects on economic growth. A balanced approach that combines equitable wealth distribution with measures that encourage economic vitality can lead to a more just and prosperous society.

Word Count: 330

Writing Tips and Key Points

Vocabulary and Grammar Notes

- Economic Disparity (noun) /ˌiː.kəˈnɒm.ɪk ˌdɪsˈpær.ɪ.ti/: A large difference in economic measures such as income.

- Progressive Taxation (noun) /prəˈɡres.ɪv ˈtæk.seɪ.ʃən/: A tax system where the tax rate increases as the taxable amount increases.

- Public Services (noun) /ˈpʌb.lɪk ˈsɜː.vɪ.sɪz/: Services provided by the government to its citizens.

- Reinvestment (noun) /ˌriː.ɪnˈvest.mənt/: The act of investing capital back into the same business.

- Human Capital (noun) /ˈhjuː.mən ˈkæp.ɪ.tl/: The skills, knowledge, and experience possessed by an individual or population.

- Inclusivity (noun) /ˌɪn.kluˈsɪv.ɪ.ti/: The practice or policy of including people who might otherwise be excluded.

Grammatical Structures

-

Complex Sentences: Use subordinating conjunctions (e.g., “although”, “because”, “since”) to show relationships between ideas.

- Example: “Although high taxes can reduce investment, progressively structured taxation is essential for diminishing economic disparity.”

-

Conditional Sentences: Important for discussing potential outcomes of economic policies.

- Example: “If the government increases taxes on high incomes, it may have more funds for public services.”

-

Passive Voice: Useful for emphasizing the action rather than the subject.

- Example: “Economic policies aimed at reducing inequality are often seen as crucial for social stability.”

Key Vocabulary to Remember

- Social Cohesion (noun) /ˈsəʊ.ʃəl kəʊˈhiː.ʒən/: The bonds or “glue” that bring people together in society.

- Social Welfare Programs (noun) /ˈsəʊ.ʃəl ˈwɛl.fɛr ˈprəʊ.ɡræmz/: Government programs designed to support the well-being of citizens.

- Economic Efficiency (noun) /ˌiː.kəˈnɒm.ɪk ɪˈfɪʃ.ən.si/: Allocation of resources in a way that maximizes productivity and economic performance.

- Tax Reforms (noun) /tæks rɪˈfɔːmz/: Changes made to a tax system to improve its functioning.

- Minimum Wage Legislation (noun): Laws that set the lowest legal wage a worker can be paid.

Conclusion

The topic of economic policies and income inequality is multifaceted and highly relevant to discussions on social stability and economic growth. Understanding and effectively articulating viewpoints on such issues are crucial for success in IELTS Writing Task 2. Remember to focus on clear argumentation, appropriate vocabulary, and varied sentence structures. Here are a few additional prompts to practice:

- “Discuss the role of global trade policies in influencing income inequality in emerging economies.”

- “Should governments prioritize economic growth over social welfare to reduce income inequality? Provide your opinion.”

- “Evaluate the effectiveness of minimum wage laws in mitigating income inequality.”

Familiarize yourself with these themes and practice constructing balanced, well-supported arguments to enhance your writing skills.